How To Get Terrible Credit Tiny Company Loans

Are you looking for a way to get some revenue to assistance you get started a business or expand a company? If you need to pay bills, cancel debt or credit card balances but your credit won’t let you to acquire a classic individual loan, you can apply for a bad credit loan to get all the funds you will need. The unsecured loans, on the other hand, can help you in finding a tiny business enterprise but in exchange of these loans you have to pay higher interest rates.

Are you looking for a way to get some revenue to assistance you get started a business or expand a company? If you need to pay bills, cancel debt or credit card balances but your credit won’t let you to acquire a classic individual loan, you can apply for a bad credit loan to get all the funds you will need. The unsecured loans, on the other hand, can help you in finding a tiny business enterprise but in exchange of these loans you have to pay higher interest rates.

It delivers a great deal of the funding for business loans created by banks in the kind of guarantees for these loans. If you have to have finance for enterprise associated activities, small business loans provide you an opportunity to access finance in an effortless manner.

As with all loan applications, there is no straight answer and in the end …

How To Get Terrible Credit Tiny Company Loans Read More

Do a search about enterprise loans and terrible credit and you will see outcome immediately after outcome touting some way or one more exactly where you can fool the banks and lenders into providing you a enterprise loan. You conveniently get authorized loan amount in your favor regardless of of getting poor credit scores including arrears, defaults, late payments, skip installments, CCJs, IVA and bankruptcy. But when it comes to startup company loans, the agency tells banks and tiny businesses that they are on their own.

Do a search about enterprise loans and terrible credit and you will see outcome immediately after outcome touting some way or one more exactly where you can fool the banks and lenders into providing you a enterprise loan. You conveniently get authorized loan amount in your favor regardless of of getting poor credit scores including arrears, defaults, late payments, skip installments, CCJs, IVA and bankruptcy. But when it comes to startup company loans, the agency tells banks and tiny businesses that they are on their own. Forget about Negative Credit Organization Advances – select for no-hassle alternative company advance financing that is effortless, swift, flexible, and handy for organization owners with significantly less than fantastic credit. A poor credit organization loan is a business loan given to borrowers who have terrible credit. Secured loans carry large amount in lieu of asset while unsecured loans carry tiny amount and charges high interest on the borrowed amount.

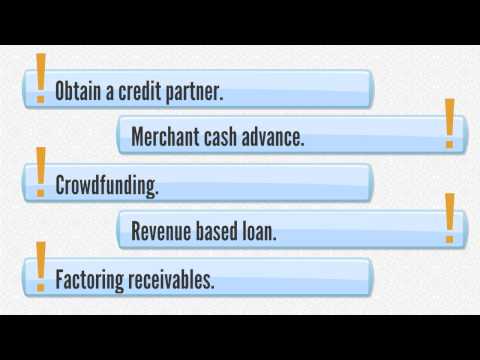

Forget about Negative Credit Organization Advances – select for no-hassle alternative company advance financing that is effortless, swift, flexible, and handy for organization owners with significantly less than fantastic credit. A poor credit organization loan is a business loan given to borrowers who have terrible credit. Secured loans carry large amount in lieu of asset while unsecured loans carry tiny amount and charges high interest on the borrowed amount. You ought to not let your bad credit score disturb whilst you decide to begin a new company. To participate in the Guaranteed Lowest Payment program, if you have a lease agreement and vendor quote which you think will qualify for the program, make contact with your National Funding Lease Manager. As we’ve observed, that financing can be challenging to come by. However, if your organization has been turned down for a bank loan, there is nevertheless hope.

You ought to not let your bad credit score disturb whilst you decide to begin a new company. To participate in the Guaranteed Lowest Payment program, if you have a lease agreement and vendor quote which you think will qualify for the program, make contact with your National Funding Lease Manager. As we’ve observed, that financing can be challenging to come by. However, if your organization has been turned down for a bank loan, there is nevertheless hope. The occurrence of young entrepreneurs, specially in the United States, is increasing. Our high approval rates mean that we can say ‘yes’ when conventional lenders say no. You will get a dedicated Loan Specialist who has particular expertise about your market and will deliver you a single-on-1 customized service. Credit cards have high interest prices couples with all kinds of other charges plus annual charges that can swiftly accumulate high debt.

The occurrence of young entrepreneurs, specially in the United States, is increasing. Our high approval rates mean that we can say ‘yes’ when conventional lenders say no. You will get a dedicated Loan Specialist who has particular expertise about your market and will deliver you a single-on-1 customized service. Credit cards have high interest prices couples with all kinds of other charges plus annual charges that can swiftly accumulate high debt.