Why Decide on A Finance Lease?

Many of us dream of buying a new automobile, On the other hand, our financial situation does not usually allow us to do so. Even so, you can normally seek for extra financing choices for your new car. Extra positive aspects include things like protection by the Customer Credit Act, smaller deposits and the potential to defer payments by such as them in the final payment if purchasing the automobile at the finish of the lease. If there are scheduled rent increases, the leveling of rent is recognized as an adjustment to the asset, as are initial direct charges and lease incentives, all of which are amortized straight-line over the lease life.

Many of us dream of buying a new automobile, On the other hand, our financial situation does not usually allow us to do so. Even so, you can normally seek for extra financing choices for your new car. Extra positive aspects include things like protection by the Customer Credit Act, smaller deposits and the potential to defer payments by such as them in the final payment if purchasing the automobile at the finish of the lease. If there are scheduled rent increases, the leveling of rent is recognized as an adjustment to the asset, as are initial direct charges and lease incentives, all of which are amortized straight-line over the lease life.

An operating lease agreement to finance gear for less than its useful life, and the lessee can return gear to the lessor at the finish of the lease period devoid of any additional obligation. Under finance lease, if …

Why Decide on A Finance Lease? Read More

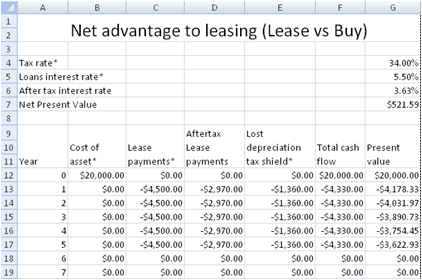

A finance lease is a rental agreement the vehicle is owned by the finance provider or lender (the lessor) and then leased to the user (the lessee) for a set term. In order to obtain classification of the type of lease you are dealing with, you must first look at the information offered within the situation and determine if the dangers and rewards linked with owning the asset are with the lessee or the lessor.

A finance lease is a rental agreement the vehicle is owned by the finance provider or lender (the lessor) and then leased to the user (the lessee) for a set term. In order to obtain classification of the type of lease you are dealing with, you must first look at the information offered within the situation and determine if the dangers and rewards linked with owning the asset are with the lessee or the lessor. The Finance & Leasing Association is the leading trade body for the asset, customer and motor finance sectors in the UK, and the largest organisation of its sort in Europe. Right here at Lease Car, we have a wide range of the most current vehicles for you to pick from. Finance and operating lease assets and liabilities are reported separately (reflecting their various character finance lease liabilities typically survive bankruptcy, for instance).

The Finance & Leasing Association is the leading trade body for the asset, customer and motor finance sectors in the UK, and the largest organisation of its sort in Europe. Right here at Lease Car, we have a wide range of the most current vehicles for you to pick from. Finance and operating lease assets and liabilities are reported separately (reflecting their various character finance lease liabilities typically survive bankruptcy, for instance). This web site makes use of cookies to give you with a far more responsive and personalised service. Account treatment: Operating lease are treated as expenses (ie off balance sheet things) where as a finance lease is included as an asset for the lessee. There are a quantity of elements which establish irrespective of whether some thing is capable of being treated as an operating lease or finance lease.

This web site makes use of cookies to give you with a far more responsive and personalised service. Account treatment: Operating lease are treated as expenses (ie off balance sheet things) where as a finance lease is included as an asset for the lessee. There are a quantity of elements which establish irrespective of whether some thing is capable of being treated as an operating lease or finance lease. Furnishings sales is a competitive market which depends on the ability to move large inventories of merchandise on a common basis to make area for the new types and colors. It is a temporary acquiring of an asset just to use it. — Whereas in a employ- buy agreement the hirer pays owner of the gear rentals that are a composite of the value, in a finance lease the lessee is paying rentals to enable the lessor recoup its capital outlay and realize income from finance charges.

Furnishings sales is a competitive market which depends on the ability to move large inventories of merchandise on a common basis to make area for the new types and colors. It is a temporary acquiring of an asset just to use it. — Whereas in a employ- buy agreement the hirer pays owner of the gear rentals that are a composite of the value, in a finance lease the lessee is paying rentals to enable the lessor recoup its capital outlay and realize income from finance charges.