Accounting For Lease Transactions

This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value.

This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value.

That said, cash flow from operations will contain only the interest portion of the capital-lease expense. Tax rulings have been issued by the ATO that seek to differentiate amongst a sale of the asset and a lease. In terms of this section 23C it is necessary that the VAT portion of expenditure is excluded from the quantity recognised for Revenue Tax purposes if …

Accounting For Lease Transactions Read More

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes.

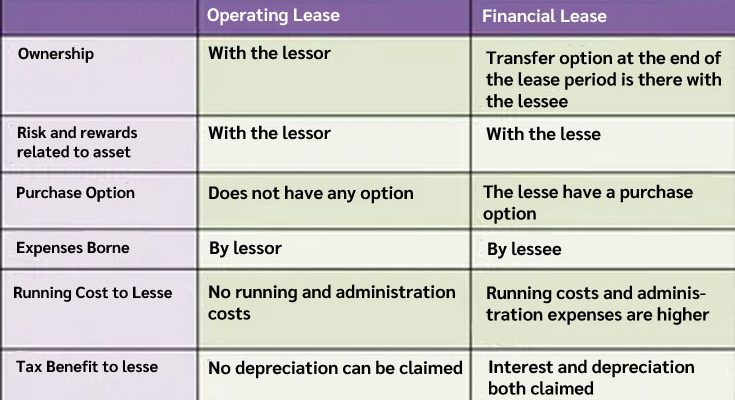

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes. As stated in IAS 17 : Leases, there are two classifications of lease transaction that applicable in the monetary statements of the lessee : (1) Operating leases and (two) Finance leases. In addition, for these vehicles with CO2 emissions exceeding 130 g/km there is a flat rate disallowance of 15% of the successful rental in accordance with the rules governing the lease rental restriction. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).

As stated in IAS 17 : Leases, there are two classifications of lease transaction that applicable in the monetary statements of the lessee : (1) Operating leases and (two) Finance leases. In addition, for these vehicles with CO2 emissions exceeding 130 g/km there is a flat rate disallowance of 15% of the successful rental in accordance with the rules governing the lease rental restriction. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).