The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes.

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes.

The lease rental will be tax deductible to the extent of the enterprise use and if a motor car, irrespective of whether the cost cost exceeds the Luxury Automobile Cost Limit ($57,180 in 2008/2009). But out of idle curiosity I picked a van at random and looked at a variety of lease deals.

The total finance charge is allocated to accounting periods in the course of the major lease term and is shown as an expense in the profit and loss account. The finance corporation are then sending out month-to-month invoices for the month-to-month payment + VAT. Within that criteria are quite a few circumstances that are practically identical to the accounting common measures for recognising finance leases.

As for NPV of the lease payments, there isn’t enough information to calculate it. As an example, even though, assuming a four-year lease and a 6% interest rate, the NPV of the payments would be less than 90% of the fair value (even if you take the £23k as getting fair value).

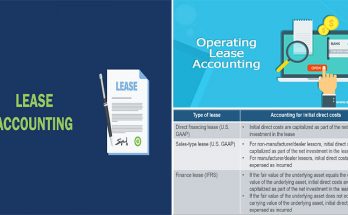

It would be typical at the finish of the lease term to agree a secondary rental (frequently named a peppercorn”). Leases are characterised as becoming either an operating or a finance lease for accounting standards but they do not, except in three specific provisions, and have a separate treatment for taxation purposes.