Operating Lease Accounting Example

Operating lease accounting is an significant part of the monetary reporting method. It assists you maintain track of lease payments and allocate total expense more than the term on the lease. This system is flexible and may follow a advantage usage pattern. Soon after the payment period, the lessor records the asset below the lease as a fixed asset and depreciates it more than its useful life. Generally, the lessor will record the total price of the lease as a straight-line expense.

You’ll Find Many Reasons Why Operating Lease Accounting is Significant for Enterprises

Very first, it allows for the measurement of cash flow. For example, an operating lease might possess a bargain obtain selection that enables the lessee to get the home at a reduce value than the actual value of the property. In addition, an operating lease may well have other terms, like a appropriate of initially refusal, …

Operating Lease Accounting Example Read More

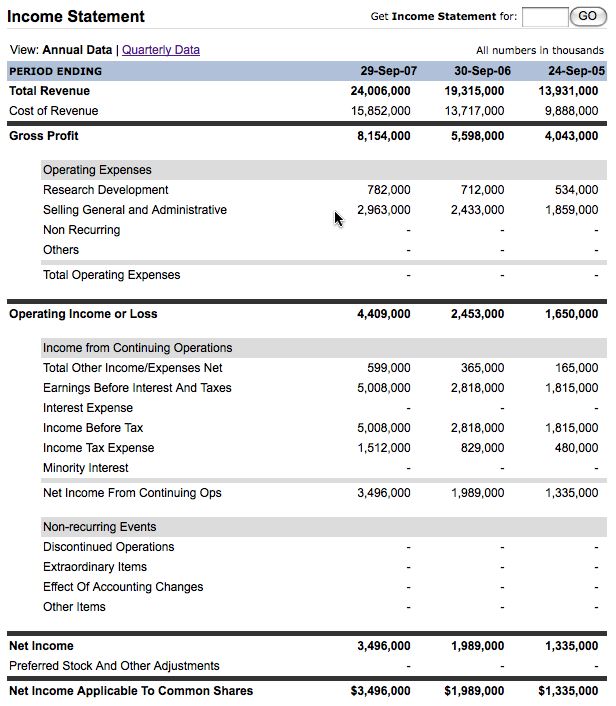

Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

A corporation need to send a summary of its annual monetary statements or a copy of a document reproducing the needed economic information and facts (such as an annual report) to the members not much less than 21 days but not far more than 60 days just before the day on which the annual meeting of members is held, or the day on which a resolution in writing is signed by the members. The most important objective of a small business is to earn a satisfactory return on the funds invested in it. Financial analysis aids in ascertaining irrespective of whether sufficient profits are becoming earned on the capital invested in the business enterprise or not.

A corporation need to send a summary of its annual monetary statements or a copy of a document reproducing the needed economic information and facts (such as an annual report) to the members not much less than 21 days but not far more than 60 days just before the day on which the annual meeting of members is held, or the day on which a resolution in writing is signed by the members. The most important objective of a small business is to earn a satisfactory return on the funds invested in it. Financial analysis aids in ascertaining irrespective of whether sufficient profits are becoming earned on the capital invested in the business enterprise or not.

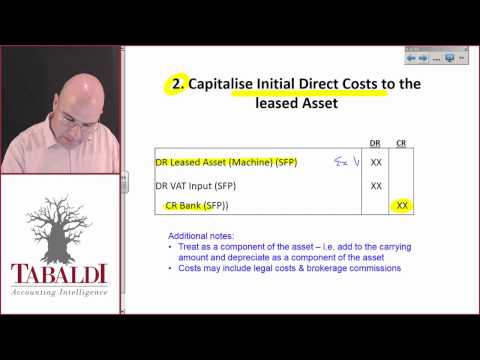

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy. China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.

China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.