Finance And Management

Compiling of the statement of financial position, the statement of complete income and the statement of cash flow the measurement and evaluation of monetary functionality with reference to profitability, liquidity and solvency analysis case research about monetary analysis introduction to the investment selection the financing selection sources of finance the dividend selection monetary organizing and the management of functioning capital with specific reference to cash, trade receivables and inventory manage economic failures international economic management. Topics involve risk and return, asset evaluation, capital budgeting, capital structure, small business economic preparing and functioning capital management. Finance for non-monetary managers can be noticed as a wonderful way to strengthen the skills and abilities of non financial managers, specially if the corporation areas a lot value on leadership that gets results.

Compiling of the statement of financial position, the statement of complete income and the statement of cash flow the measurement and evaluation of monetary functionality with reference to profitability, liquidity and solvency analysis case research about monetary analysis introduction to the investment selection the financing selection sources of finance the dividend selection monetary organizing and the management of functioning capital with specific reference to cash, trade receivables and inventory manage economic failures international economic management. Topics involve risk and return, asset evaluation, capital budgeting, capital structure, small business economic preparing and functioning capital management. Finance for non-monetary managers can be noticed as a wonderful way to strengthen the skills and abilities of non financial managers, specially if the corporation areas a lot value on leadership that gets results.

In the absence of these critical aspects in the finance function, the traditional approach implied a really narrow scope of economic management. …

Finance And Management Read More

Double Degree with Ecole Supérieure de Commerce de Paris-Europe (France) At the finish of their study programme students can be awarded with a double degree: Master’s Degree in Accounting and Management of Università Ca’ Foscari Venezia and Master in Management of ESCP-Europe. You may locate yourself working in a international corporation, a little to medium-sized enterprise (SME) or even for your self – it really is not unusual for corporation CEOs to come from an accounting or finance background. A student studying extra finance classes in place of other electives will receive a difficult education that can assist expand believed processes.

Double Degree with Ecole Supérieure de Commerce de Paris-Europe (France) At the finish of their study programme students can be awarded with a double degree: Master’s Degree in Accounting and Management of Università Ca’ Foscari Venezia and Master in Management of ESCP-Europe. You may locate yourself working in a international corporation, a little to medium-sized enterprise (SME) or even for your self – it really is not unusual for corporation CEOs to come from an accounting or finance background. A student studying extra finance classes in place of other electives will receive a difficult education that can assist expand believed processes. It appears like there is no Newsday subscription account associated with this login info. Menurut sudut pandang kriminologi interaksionis, maka debt collector yang semula hanya ditugasi untuk menagih hutang namun karena kerapkali melakukan kekerasan saat beroperasi dan hal itu berulang-ulang, maka masyarakat yang melihatnya atau kreditur-kreditur yang mengalaminya kemudian memberikan label atau cap atas hasil interaksi DC ketika menagih hutang.

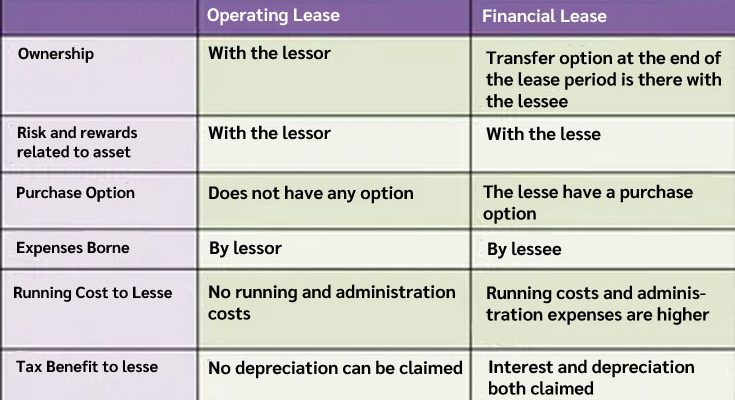

It appears like there is no Newsday subscription account associated with this login info. Menurut sudut pandang kriminologi interaksionis, maka debt collector yang semula hanya ditugasi untuk menagih hutang namun karena kerapkali melakukan kekerasan saat beroperasi dan hal itu berulang-ulang, maka masyarakat yang melihatnya atau kreditur-kreditur yang mengalaminya kemudian memberikan label atau cap atas hasil interaksi DC ketika menagih hutang. Where a enterprise concludes a financial lease for an asset, it is vital from an accounting point of view to record the asset in the books of account with each other with the corresponding liability relating thereto. Consequently, the lessee needs to lessen the deduction claimed on the rental installments with the VAT portion that relates to it. Because input tax is claimable as soon as-off at the commencement of a finance lease, it requirements to be determined how significantly of the total VAT paid in terms of the agreement relates to the rental payments in fact incurred in the course of the assessment period.

Where a enterprise concludes a financial lease for an asset, it is vital from an accounting point of view to record the asset in the books of account with each other with the corresponding liability relating thereto. Consequently, the lessee needs to lessen the deduction claimed on the rental installments with the VAT portion that relates to it. Because input tax is claimable as soon as-off at the commencement of a finance lease, it requirements to be determined how significantly of the total VAT paid in terms of the agreement relates to the rental payments in fact incurred in the course of the assessment period.