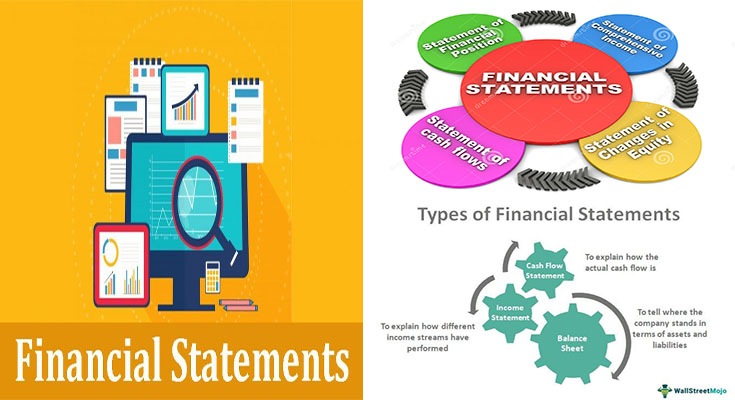

You will find four main kinds of financial statements: revenue statement, cash flow statement, and balance sheet. No matter if they’re created quarterly, monthly, or yearly, the purpose of every kind of statement is the same. Commonly, financial statements really should be ready in standardized formats. The following examples highlight probably the most popular kinds of financial statements. Let’s appear at everyone in extra detail. And don’t forget, if you’re unsure of what they imply, you’ll be able to generally ask your accountant or bookkeeper for suggestions.

Balance Sheet

A balance sheet can be a statement of how much the enterprise has in equity. This consists of the number of shares and also the value from the company’s assets. They are important pieces of information and facts for shareholders. The income statement shows the volume of money generated by the firm. The money flow statement specifics the level of money the organization has in hand. Additionally, to cash flow, the balance sheet also reflects alterations within the quantity of the debt that the organization has in its bank accounts.

A balance sheet shows the organization’s assets and liabilities. Assets include things like money, home, inventory, and also other things owned by the business. Liabilities are accounts payable and payments made on a long-term loan. The additions and subtractions to the balance sheet might be net revenue, dividend payments, and withdrawals. One of the most typical kinds of financial statements is a profit and loss statement, the income statement, plus the cash flow statement.

Income Statement

An income statement lists revenue earned by the firm. Additionally, it lists the expenses that the company incurs while earning revenue. Retained earnings are vital mainly because they indicate no matter whether the business enterprise can continue to meet its obligations without added capital. They are also helpful for assessing the monetary wellness of a small business. They will also assist potential creditors and investors evaluate the company’s overall performance. They’re useful for many purposes, such as evaluating trends. The following varieties of financial statements are normally utilized by enterprises.

Cash Flow Statement

Another essential type of economic statement is often a cash flow statement. This document reveals inflows and outflows of money during the reporting period. The revenue statement is divided into 3 sub-sections: revenue, expenses, and equity. The latter two are extra normally issued to outdoors parties. Nevertheless, you’ll find other sorts of financial statements that are not included within a company’s earnings and money flow. If you are looking for an example of a business’s earnings and assets, take into account pursuing a degree in finance.

Resume

The purpose of a financial statement is always to assess an entity’s overall performance. A business is usually a company if it earns a profit. Therefore, a financial statement will show the profitability and liabilities of the enterprise. In addition, it allows you to know the owner’s interest in profits and losses. As opposed to a loan, a creditor’s debt is not an asset to an organization. For this reason, the income statement may be the most significant of all the financial statements.