An operating lease is a leasing contract which contains terms that are quick relative to the beneficial life of the asset in question. When an investor tries to assess a company’s leverage, a standard place to commence is the balance sheet’s debt, which is compared to either market place or book value of equity. The reduce in the asset and liability represents the lease expense, less the linked interest.

An operating lease is a leasing contract which contains terms that are quick relative to the beneficial life of the asset in question. When an investor tries to assess a company’s leverage, a standard place to commence is the balance sheet’s debt, which is compared to either market place or book value of equity. The reduce in the asset and liability represents the lease expense, less the linked interest.

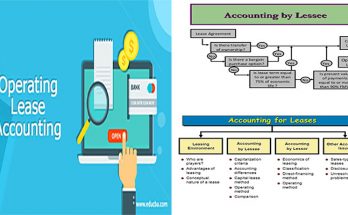

If none of these circumstances are met, the lease need to be classified as an operating lease. Note, however, that amortization expense connected with the suitable-of-use asset is calculated on a straight-line basis over the life of the underlying lease contract, and the lease liability is reduced using the helpful interest technique.

The lease receivable is also shown as an asset on the balance sheet, and the interest income is recognized over the term of the lease, as paid. Converting an operating lease to debt involves taking operating lease future payments and calculating their present worth working with a discount rate for the company’s unsecured debt.

The lessor uses the identical criteria for figuring out no matter whether the lease is a capital or operating lease and accounts for it accordingly. Whilst cost-free cash flow will be the similar, the disclosure has been brought to the economic statements. By classifying a lease as either capital or operating lease, you will be able to figure out how payments for the lease will be treated in the economic statements.

On the other hand, the ASU consists of some targeted improvements that are intended to align, exactly where important, lessor accounting with the lessee accounting model and with the updated income recognition guidance issued in 2014. Since the lessee does not assume the risk of ownership, the lease expense is treated as an operating expense in the revenue statement and the lease does not impact the balance sheet.