Accounting and Finance Definition

In accounting, economic effects of transactions are recorded as they happen, not when money is paid or received. Income is recognized when it truly is earned and expense is recognized when it truly is incurred. As an example, when a enterprise sells a certain asset, the interest it earns is recorded as earnings, not when it can be paid. An example of a match principle is definitely the recognition of interest in between the date the security is paid along with the date it can be sold.

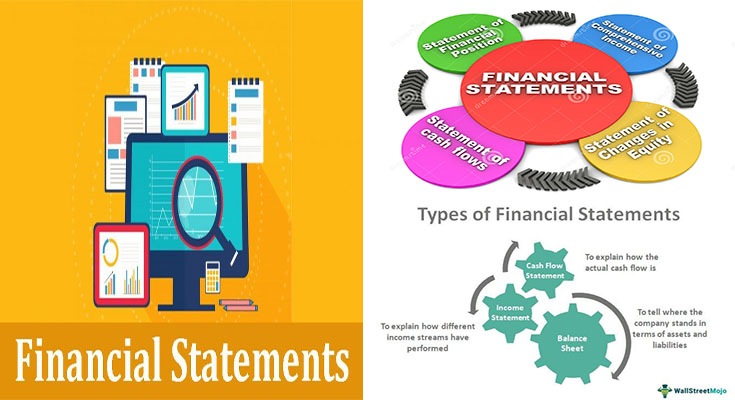

The accounting and finance definition of profit refers to the process of recording and analyzing financial information. The major function of accounting is usually to record business transactions. On the other hand, the discipline can be applied to strategy to get a business’ future development. Understanding cashflow can also allow you to prevent failure. As such, it is important to know ways to …

Accounting and Finance Definition Read More