Operating Lease Accounting Example

Operating lease accounting is an significant part of the monetary reporting method. It assists you maintain track of lease payments and allocate total expense more than the term on the lease. This system is flexible and may follow a advantage usage pattern. Soon after the payment period, the lessor records the asset below the lease as a fixed asset and depreciates it more than its useful life. Generally, the lessor will record the total price of the lease as a straight-line expense.

You’ll Find Many Reasons Why Operating Lease Accounting is Significant for Enterprises

Very first, it allows for the measurement of cash flow. For example, an operating lease might possess a bargain obtain selection that enables the lessee to get the home at a reduce value than the actual value of the property. In addition, an operating lease may well have other terms, like a appropriate of initially refusal, …

Operating Lease Accounting Example Read More

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets.

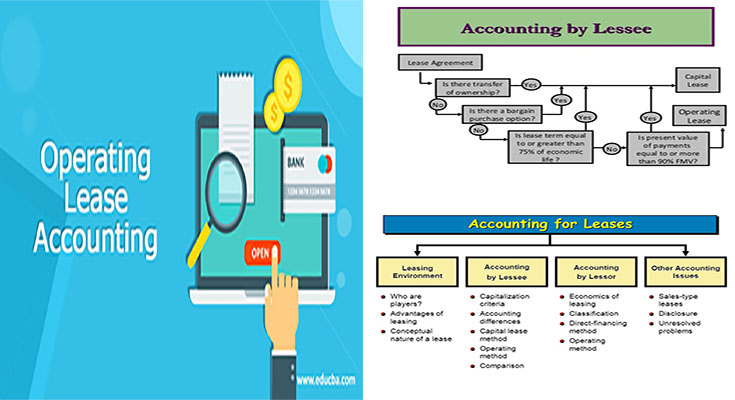

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets. Organisations often select to lease long-term assets rather than acquiring them. For instance, considering the fact that a real estate lease is often quick-term (12 months or less), it would most most likely be treated as an operating lease by the lessor, and a single-expense lease by the lessee. Hence, the lessee in a capital lease need to record the leased property as an asset and the lease obligation as a liability.

Organisations often select to lease long-term assets rather than acquiring them. For instance, considering the fact that a real estate lease is often quick-term (12 months or less), it would most most likely be treated as an operating lease by the lessor, and a single-expense lease by the lessee. Hence, the lessee in a capital lease need to record the leased property as an asset and the lease obligation as a liability. Commonly accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as ‘a lease other than a finance lease’. Economic Accounting Standards Board will need capitalizing operating leases in 2019, ending the distinction amongst operating and capital leases. For the reason that an organization does not own the asset, it is not recorded on the firm’s balance sheet.

Commonly accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as ‘a lease other than a finance lease’. Economic Accounting Standards Board will need capitalizing operating leases in 2019, ending the distinction amongst operating and capital leases. For the reason that an organization does not own the asset, it is not recorded on the firm’s balance sheet. The FASB and IASB teamed up and mutually agreed upon a a lot more representative approach to accounting for leases that will most likely come into impact in the subsequent few years. A straightforward transform in accounting approaches will hence discover providers in violation of previously established debt covenants (Fitch: Slow Progress on GAAP). The FASB and IASB have discussed a converged regular for lease accounting that would effect the manner in which each lessees and lessors report such transactions.

The FASB and IASB teamed up and mutually agreed upon a a lot more representative approach to accounting for leases that will most likely come into impact in the subsequent few years. A straightforward transform in accounting approaches will hence discover providers in violation of previously established debt covenants (Fitch: Slow Progress on GAAP). The FASB and IASB have discussed a converged regular for lease accounting that would effect the manner in which each lessees and lessors report such transactions.