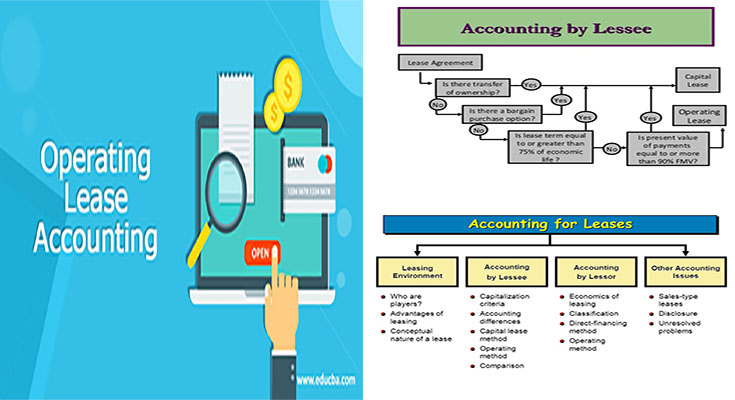

Operating lease accounting is an significant part of the monetary reporting method. It assists you maintain track of lease payments and allocate total expense more than the term on the lease. This system is flexible and may follow a advantage usage pattern. Soon after the payment period, the lessor records the asset below the lease as a fixed asset and depreciates it more than its useful life. Generally, the lessor will record the total price of the lease as a straight-line expense.

You’ll Find Many Reasons Why Operating Lease Accounting is Significant for Enterprises

Very first, it allows for the measurement of cash flow. For example, an operating lease might possess a bargain obtain selection that enables the lessee to get the home at a reduce value than the actual value of the property. In addition, an operating lease may well have other terms, like a appropriate of initially refusal, and that selection is recorded as an expense on the P&L.

Complete Lease Receipts

Another benefit of operating lease accounting is that the payments are included in the income statement and expense account. Additionally, complete lease receipts are included in the operating money flow statement. This means that interest costs, depreciation, and amortization are included in the income statement. However, the income statement will include all the payments made during the term on the lease. If the payment period is longer than 12 months, the leasing agreement must be included on the balance sheet.

In the past, operating leases were treated as off-balance-sheet transactions, with the rent expense associated with them accounted for as an expense around the income statement. This made comparisons difficult because the amount of transparency was lacking. Therefore, the FASB issued ASC 842, Leases, which requires that all leasing transactions be recorded on the balance sheet. Furthermore, it mandates that all operating leases be recognized on the balance sheet.

Must Find the Debt Value

For operating lease accounting, the lessor must find the debt value on the asset to recognize its future expense. In other words, the lessor will have to discount the rental payments by the price on the debt, which is the return to creditors. This is the most common system used for this purpose. Also to the WACC calculations, the lessee and the lessor can also use the annuity system for their operating leases. It will also be possible to calculate the present value on the lease payments, if the duration from the term is longer than 12 months. In the United States, the FASB issued ASU 2016-02, which amended the previous guidance. IASB and the FASB started the project jointly, and opted to apply the same model to both the lessee. For the purposes of this accounting, the lessor must calculate the residual value of your lease payments before capitalizing the asset. The remaining price of an operating lease is the amount from the total lease payments minus the initial costs.