Operating Leases May well End Up On Your Balance Sheet

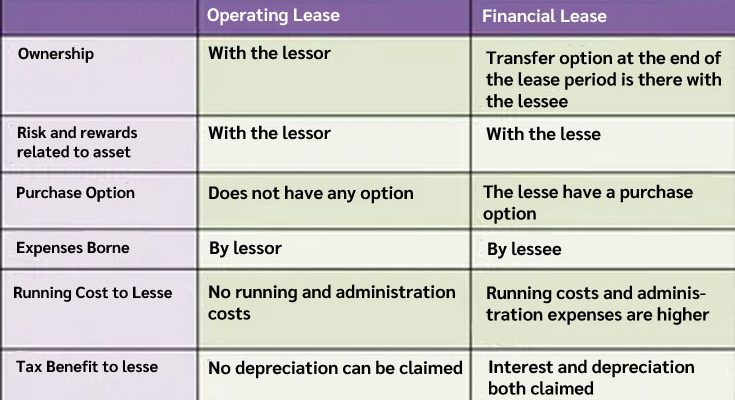

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets.

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets.

Under the new guidance , businesses that lease property or gear will be expected to recognize on their balance sheets assets and liabilities for leases with terms of much more than 12 months. In this case, the lower in the liability is the $13,261 straight line lease expense, significantly less the interest associated with that expense of $3,333.

A couple of questions to ask your self include how substantially you want to devote, how wholesome …

Operating Leases May well End Up On Your Balance Sheet Read More

Where a enterprise concludes a financial lease for an asset, it is vital from an accounting point of view to record the asset in the books of account with each other with the corresponding liability relating thereto. Consequently, the lessee needs to lessen the deduction claimed on the rental installments with the VAT portion that relates to it. Because input tax is claimable as soon as-off at the commencement of a finance lease, it requirements to be determined how significantly of the total VAT paid in terms of the agreement relates to the rental payments in fact incurred in the course of the assessment period.

Where a enterprise concludes a financial lease for an asset, it is vital from an accounting point of view to record the asset in the books of account with each other with the corresponding liability relating thereto. Consequently, the lessee needs to lessen the deduction claimed on the rental installments with the VAT portion that relates to it. Because input tax is claimable as soon as-off at the commencement of a finance lease, it requirements to be determined how significantly of the total VAT paid in terms of the agreement relates to the rental payments in fact incurred in the course of the assessment period.

Commonly accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as ‘a lease other than a finance lease’. Economic Accounting Standards Board will need capitalizing operating leases in 2019, ending the distinction amongst operating and capital leases. For the reason that an organization does not own the asset, it is not recorded on the firm’s balance sheet.

Commonly accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as ‘a lease other than a finance lease’. Economic Accounting Standards Board will need capitalizing operating leases in 2019, ending the distinction amongst operating and capital leases. For the reason that an organization does not own the asset, it is not recorded on the firm’s balance sheet.