This is the company’s report card and it shows the financial position of the business enterprise at a specific date. So I suspect that in your example, if at the end of four years a lessor was carrying a genuine residual exposure in the gear of 25% and its margin return was dependent upon recovering that residual investment then it would satisfy the 1st test above (bear in mind the old SSAP21 90/10 rule).

Arguably the revenue must be indifferent to a finance lease becoming taxed in the exact same way as other varieties of leases. The fact that the rentals do not cover the cost is a nonsense, the alternative for a peppercorn rent at the finish of the lease proves that the asset is fully paid for by then, no matter what the headline cost says.

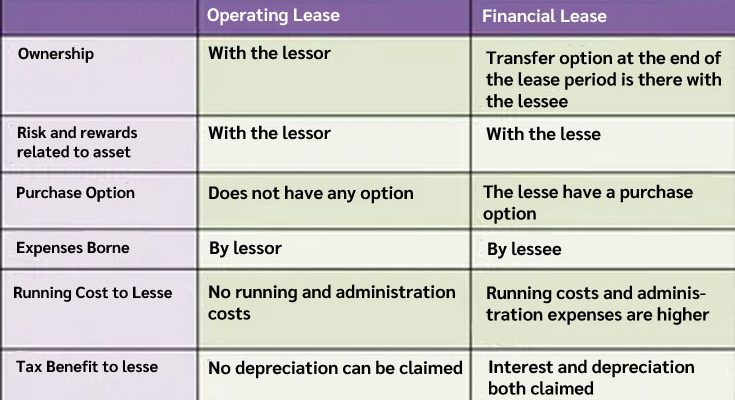

Income tax implications: Operating lease is 100% tax deductible supplied the equipment is for business use. Ownership of the asset remains with the lessor and the asset will either be returned at the finish of the lease, when the leasing organization will either re-hire in a further contract or sell it to release the residual value.

If, in the alternative, a finance lease was taxed on a loan basis the lessee would claim the interest element in the rental payments as a deduction and the equivalent amount would be assessed to the lessor, plus it would claim the capital allowances deductions.

The Earnings Tax implications that may possibly outcome in every single of these circumstances are addressed under. Finance leases transfer the capital allowance deductions to debt providers in a leasing transaction, which is the similar result as for equity owners. The lessor retains ownership of the car, while the lessee assumes the risk of the residual worth.