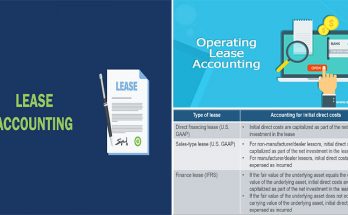

In the world of accounting, the treatment of finance leases under the Generally Accepted Accounting Principles (GAAP) is a crucial aspect that provides transparency and accuracy in financial reporting. A finance lease is a type of lease that transfers substantially all the risks and rewards incidental to ownership of an asset to the lessee. In this article, we will delve into the accounting treatment of finance leases under GAAP.

Recognition and Measurement

Under GAAP, finance leases are recognized as assets and liabilities on the lessee’s balance sheet. The initial recognition of the lease liability is based on the present value of the lease payments discounted at the interest rate implicit in the lease or, if that rate cannot be readily determined, the lessee’s incremental borrowing rate. Simultaneously, the lessee recognizes a right-of-use asset at the same amount as the lease liability.

Subsequent Measurement

After initial recognition, the lease liability is measured at amortized cost using the effective interest method. The right-of-use asset is depreciated over the shorter of the lease term or the useful life of the asset.

Presentation in Financial Statements

In the lessee’s financial statements, the lease liability is reported as a non-current liability, while the right-of-use asset is presented as a non-current asset on the balance sheet. The interest expense on the lease liability and the depreciation expense on the right-of-use asset are recognized in the income statement.

Disclosures

GAAP requires extensive disclosures related to finance leases in the notes to the financial statements. These disclosures typically include information about the terms and conditions of the leases, future lease payments, and maturity analysis of the lease liabilities.

Impact on Financial Ratios

The accounting treatment of finance leases has a significant impact on various financial ratios such as leverage, liquidity, and profitability. Recognizing lease liabilities and right-of-use assets on the balance sheet can increase the lessee’s leverage ratios, affect liquidity ratios due to the additional liabilities, and impact profitability ratios through higher depreciation and interest expenses.

Understanding the accounting treatment of finance leases under GAAP is essential for accurate financial reporting and decision-making. It ensures that the financial statements reflect the economic substance of the lease agreements and provide users of the financial statements with meaningful information about the entity’s financial position and performance.