The distinction between capital and operating leases is a fundamental concept in lease accounting that impacts how leases are treated on financial statements. Understanding the rules for finance lease accounting can provide clarity on how these leases are recognized, measured, and disclosed in financial reporting. In this article, we will explore the finance lease accounting rules for capital versus operating leases.

Capital Lease Accounting

A capital lease is a type of lease that effectively transfers the risks and rewards of ownership from the lessor to the lessee. Under lease accounting rules, a capital lease is treated as a purchase of the leased asset, and both the asset and liability related to the lease are recorded on the lessee’s balance sheet.

- Recognition: The lessee recognizes the leased asset and the corresponding lease liability on the balance sheet at the present value of the lease payments.

- Amortization: The lease liability is amortized over the lease term, and the interest expense is recognized in the income statement over time.

- Depreciation: The leased asset is depreciated over its useful life, reflecting its economic benefit to the lessee.

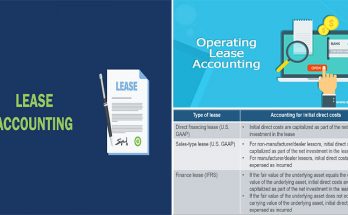

Operating Lease Accounting

An operating lease, on the other hand, is treated as a rental agreement, and the leased asset is not recognized on the lessee’s balance sheet. Instead, lease payments are expensed as operating expenses in the income statement over the lease term.

- Recognition: Only lease payments are expensed as operating expenses, and the lease does not give rise to an asset or liability on the balance sheet.

- Measurement: Operating lease payments are recorded as a straight-line expense over the lease term, maintaining a consistent expense recognition pattern.

Finance Lease Accounting Rules

The accounting rules for finance leases are primarily governed by the Financial Accounting Standards Board (FASB) in the United States and the International Financial Reporting Standards (IFRS) globally. Both FASB and IFRS provide guidelines on how to classify leases as finance leases or operating leases based on specific criteria.

- Criteria for Finance Lease Classification: Key criteria for classifying a lease as a finance lease include the transfer of ownership at the end of the lease term, the option to purchase the asset at a bargain price, the lease term covering a significant portion of the asset’s economic life, and the present value of lease payments substantially representing the asset’s fair value.

- Impact on Financial Statements: Finance leases significantly impact the lessee’s balance sheet by recognizing the leased asset and corresponding lease liability. This enhances transparency and provides a more accurate representation of the lessee’s financial position.

Understanding the finance lease accounting rules for capital versus operating leases is essential for financial reporting accuracy and transparency. By correctly classifying leases and applying the appropriate accounting treatment, businesses can comply with accounting standards and provide stakeholders with a clearer picture of their financial obligations and assets arising from lease agreements.