What is Finance Lease?

A finance lease can be a contract whereby a business will finance a piece of equipment after which return it at the finish of your term. The terms of your contract are usually non-cancellable, and also the buyer ought to make all rental payments during the main term. The client is also required to create a balloon payment at the finish of your contract, which is a large sum of income. Because the client is expected to make all rental payments, a finance lease is usually a fantastic solution for him.

A finance lease is usually a contract in which a lessor buys an asset from a lessee in return for a fixed monthly payment. The owner of the asset, generally known as the lessor, transfers the dangers and rewards of ownership for the lessee, in return to get a fixed rent. This kind of lease is the most common …

What is Finance Lease? Read More

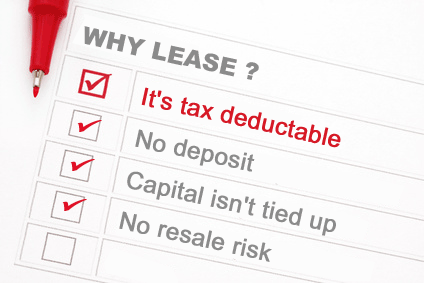

Leasing is an old system of financing which is now gaining reputation practically in whole globe. As finance leases are taxed in exactly the exact same away as other leases, exactly where the rentals are totally deductible to the lessee and assessable to the lessor, a finance lease is tax advantaged, which includes fully deductible repayment of the expense of the asset or of the loan, and transfer of the entitlement to capital allowance deductions from holding the asset to the non-economic owner (the lessor).

Leasing is an old system of financing which is now gaining reputation practically in whole globe. As finance leases are taxed in exactly the exact same away as other leases, exactly where the rentals are totally deductible to the lessee and assessable to the lessor, a finance lease is tax advantaged, which includes fully deductible repayment of the expense of the asset or of the loan, and transfer of the entitlement to capital allowance deductions from holding the asset to the non-economic owner (the lessor). For any one who is contemplating hiring or leasing a car or truck, irrespective of whether for single trips or every day life, there will always be that extra concern of how to finance your arrangement. Hopefully this fast guide has supplied you with an introduction to financing your employ or lease arrangements and to let you to further investigate every single solution to maximise your investment and minimise your expense. Accounting regulations are under assessment, however at the current time, operating leases are an off balance sheet arrangement and finance leases are on balance sheet.

For any one who is contemplating hiring or leasing a car or truck, irrespective of whether for single trips or every day life, there will always be that extra concern of how to finance your arrangement. Hopefully this fast guide has supplied you with an introduction to financing your employ or lease arrangements and to let you to further investigate every single solution to maximise your investment and minimise your expense. Accounting regulations are under assessment, however at the current time, operating leases are an off balance sheet arrangement and finance leases are on balance sheet. For VAT registered providers that want to offset the administration of their vehicles but have the asset shown on their balance sheet, Finance lease is the ideal option. At the end of the Finance Lease term, you can take ownership of the gear basically by paying the stated residual value. A sales-sort lease permits instant recognition of profit a direct financing lease recognizes the profit from the distinction in between the fair value and carrying amount though interest income over the life of the lease.

For VAT registered providers that want to offset the administration of their vehicles but have the asset shown on their balance sheet, Finance lease is the ideal option. At the end of the Finance Lease term, you can take ownership of the gear basically by paying the stated residual value. A sales-sort lease permits instant recognition of profit a direct financing lease recognizes the profit from the distinction in between the fair value and carrying amount though interest income over the life of the lease.