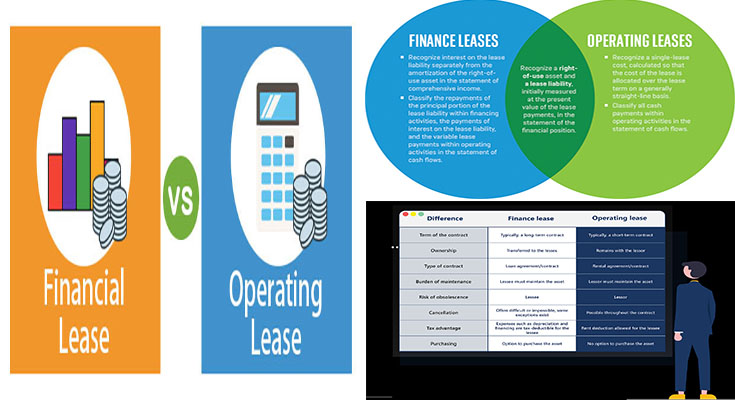

Capital vs. Operating Lease: Finance Lease Accounting Rules

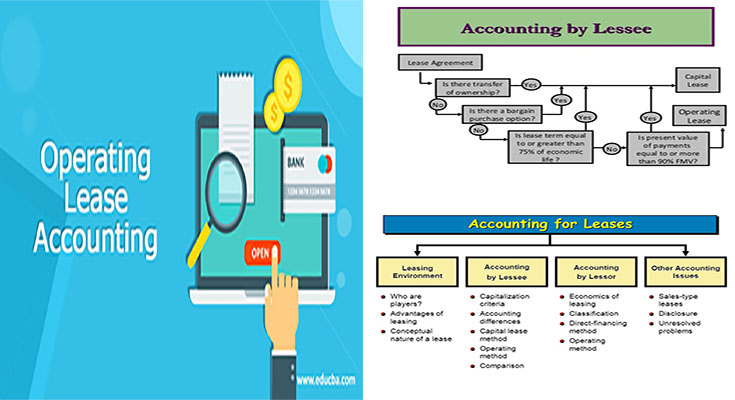

The distinction between capital and operating leases is a fundamental concept in lease accounting that impacts how leases are treated on financial statements. Understanding the rules for finance lease accounting can provide clarity on how these leases are recognized, measured, and disclosed in financial reporting. In this article, we will explore the finance lease accounting rules for capital versus operating leases.

Capital Lease Accounting

A capital lease is a type of lease that effectively transfers the risks and rewards of ownership from the lessor to the lessee. Under lease accounting rules, a capital lease is treated as a purchase of the leased asset, and both the asset and liability related to the lease are recorded on the lessee’s balance sheet.

- Recognition: The lessee recognizes the leased asset and the corresponding lease liability on the balance sheet at the present value of the lease payments.

- Amortization: The lease liability