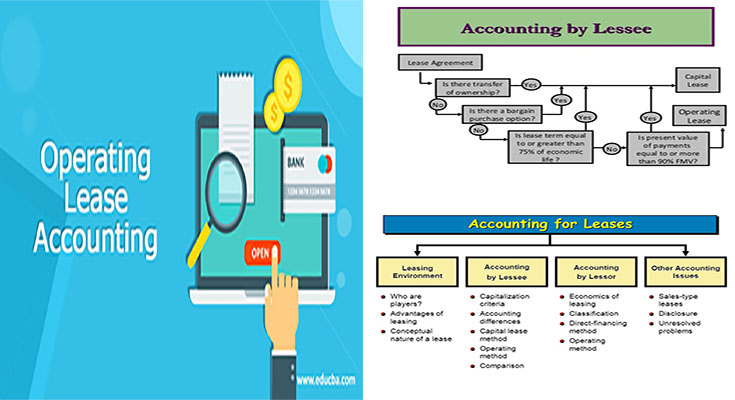

Operating Lease Accounting Example

Operating lease accounting is an significant part of the monetary reporting method. It assists you maintain track of lease payments and allocate total expense more than the term on the lease. This system is flexible and may follow a advantage usage pattern. Soon after the payment period, the lessor records the asset below the lease as a fixed asset and depreciates it more than its useful life. Generally, the lessor will record the total price of the lease as a straight-line expense.

You’ll Find Many Reasons Why Operating Lease Accounting is Significant for Enterprises

Very first, it allows for the measurement of cash flow. For example, an operating lease might possess a bargain obtain selection that enables the lessee to get the home at a reduce value than the actual value of the property. In addition, an operating lease may well have other terms, like a appropriate of initially refusal, …

Operating Lease Accounting Example Read More

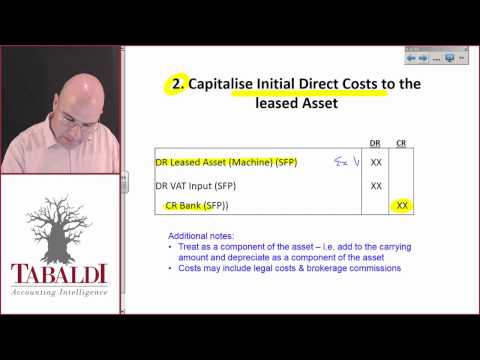

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy. China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.

China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall. This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value.

This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value. Leasing is an old system of financing which is now gaining reputation practically in whole globe. As finance leases are taxed in exactly the exact same away as other leases, exactly where the rentals are totally deductible to the lessee and assessable to the lessor, a finance lease is tax advantaged, which includes fully deductible repayment of the expense of the asset or of the loan, and transfer of the entitlement to capital allowance deductions from holding the asset to the non-economic owner (the lessor).

Leasing is an old system of financing which is now gaining reputation practically in whole globe. As finance leases are taxed in exactly the exact same away as other leases, exactly where the rentals are totally deductible to the lessee and assessable to the lessor, a finance lease is tax advantaged, which includes fully deductible repayment of the expense of the asset or of the loan, and transfer of the entitlement to capital allowance deductions from holding the asset to the non-economic owner (the lessor).