Personal Budgeting Strategies – 4 Common Personal Finance Management Mistakes to Avoid

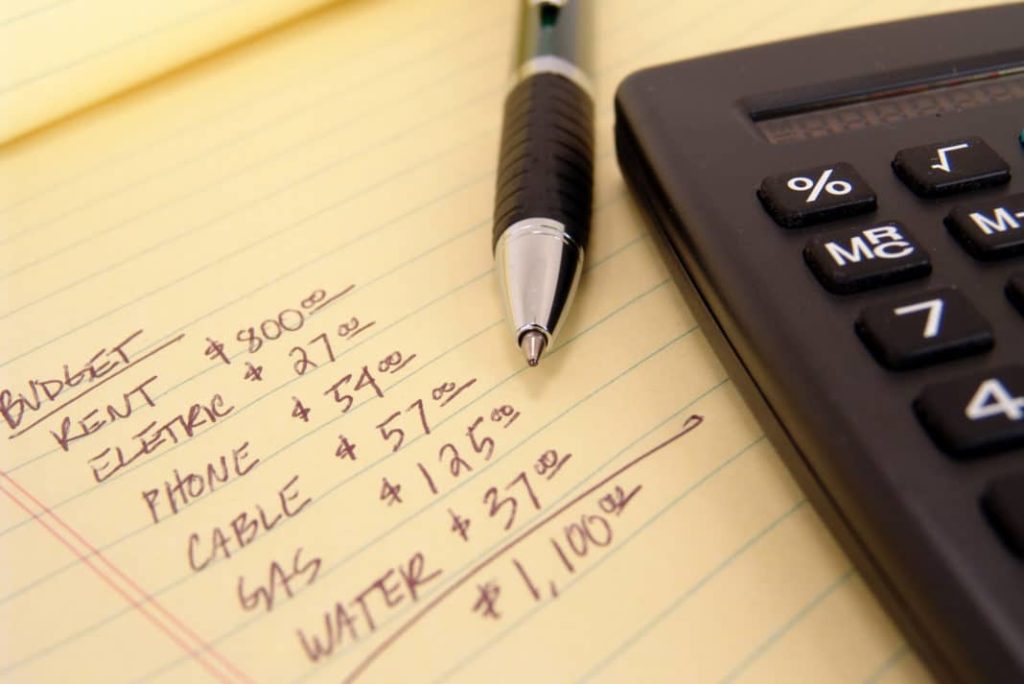

“Personal budgeting strategies”, “what is budgeting” and “why is budgeting important” are very crucial topics and queries as of late. The truth is, should you do not have sound individual budgeting techniques, you might constantly be in debt and you will always be unable to save dollars – irrespective of how much income you earn.

Studies have shown that poor personal finance management is one of the major causes of rift among couples. Apart from affecting your personal life, your future is dependent on the way in which you control your expenses. That is why it is so important to follow a carefully considered budget, which can help you to manage your financial situation in a better manner and have enough savings to live the rest of your life in peace.

For many people, a large percentage of their income is wasted in paying huge credit card bills …

Personal Budgeting Strategies – 4 Common Personal Finance Management Mistakes to Avoid Read More