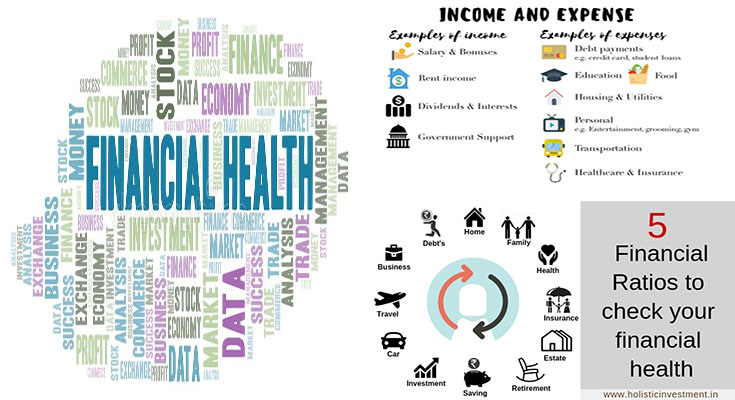

Financial Health Examples – How to Achieve Financial Health

These financial health strategies are aimed at folks that are worried about their finances but cannot afford to take drastic measures. Fortunately, they’re easy to implement and will lead to a healthier, much more financially stable life. Irrespective of whether you’re in the industry to get a new house, a vehicle, or maybe a new job, you’ll be able to use these tricks to make the most of one’s money. Listed beneath are a few of the ideal methods to obtain started on the path to a financially healthier future.

Enhancing Your Financial Health Is Always to Calculate Your Net Worth, Assets, And Debts

This will likely assist you to create a spending budget that should permit you to live within your means. You are going also need to have to know your desires and requirements so you can determine just how much to spend on each. The next step …

Financial Health Examples – How to Achieve Financial Health Read More