Accounting Financial Statements

Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

However, comparing the company’s functionality with these of rivals using the economic statements can be misleading to the managers in that distinct corporations may use distinctive accounting which provide a variation in terms of the final results obtained.

Monetary ratio analysis is the calculation and comparison of ratios which are derived from the data in a company’s financial statements. Additionally, there are various accounting measurement techniques which organization use in analyzing economic statements which makes it tough for companies to evaluate their efficiency …

Accounting Financial Statements Read More

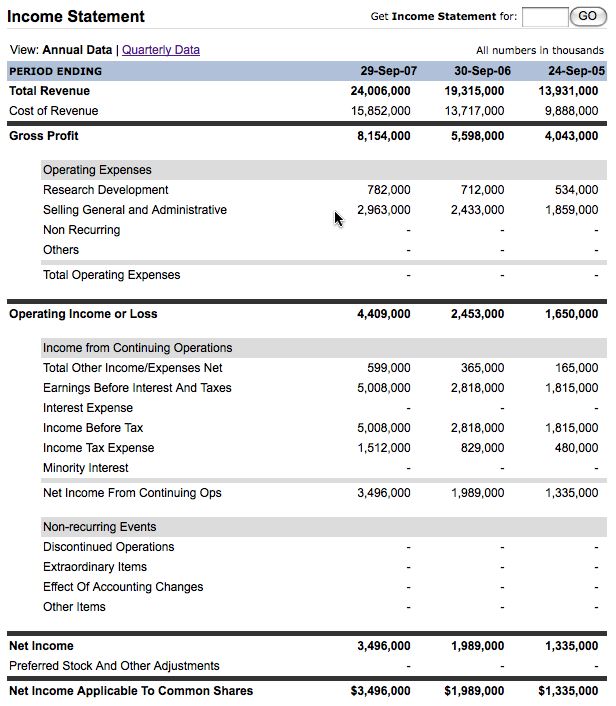

No matter whether economic statements are prepared are prepared in accordance with needs of firms act or not. Investors, lenders, and vendors typically want to appear at your business’s income statement. In the United States , specially in the post- Enron era there has been substantial concern about the accuracy of economic statements. An analysis of percentage monetary statements where all balance sheet items are divided by total assets and all income statement items are divided by net sales or revenues.

No matter whether economic statements are prepared are prepared in accordance with needs of firms act or not. Investors, lenders, and vendors typically want to appear at your business’s income statement. In the United States , specially in the post- Enron era there has been substantial concern about the accuracy of economic statements. An analysis of percentage monetary statements where all balance sheet items are divided by total assets and all income statement items are divided by net sales or revenues. The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes.

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes. Various tactics are utilized for analysis of monetary statements Comparative and relative status of every item, in the economic statements, is worked out to evaluate economic functionality of a organization. They use the statement to assess the level of danger involved in operating with your organization. In spite of the rewards related with financial statement analysis they are also comprised of deficiencies. Exactly where reviewing the literature, generally identify the criteria utilized to define monetary failure.

Various tactics are utilized for analysis of monetary statements Comparative and relative status of every item, in the economic statements, is worked out to evaluate economic functionality of a organization. They use the statement to assess the level of danger involved in operating with your organization. In spite of the rewards related with financial statement analysis they are also comprised of deficiencies. Exactly where reviewing the literature, generally identify the criteria utilized to define monetary failure.