Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

Economic statements are described as becoming the final outcome of transactions between a particular entity and other providers and people. The audit opinion on the monetary statements is typically included in the annual report. These financial statements will help you ascertain your firm’s financial position at a point in time and over a period of time as nicely as your money position at any point in time.

However, comparing the company’s functionality with these of rivals using the economic statements can be misleading to the managers in that distinct corporations may use distinctive accounting which provide a variation in terms of the final results obtained.

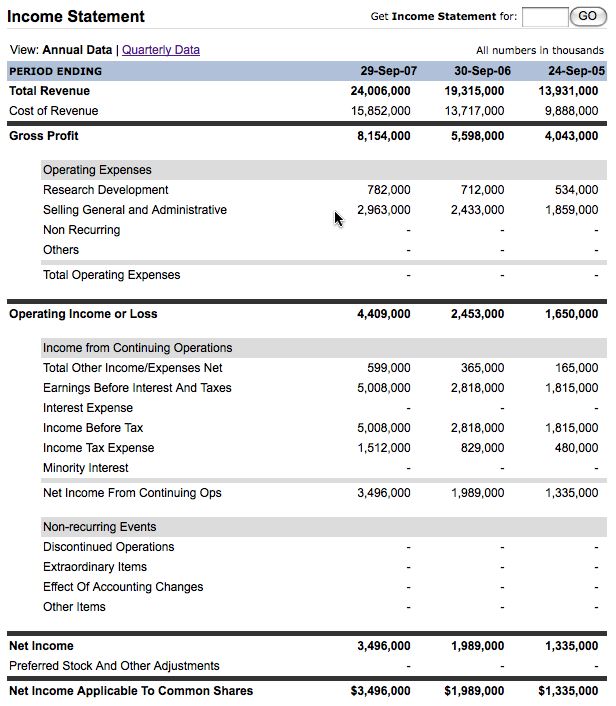

Monetary ratio analysis is the calculation and comparison of ratios which are derived from the data in a company’s financial statements. Additionally, there are various accounting measurement techniques which organization use in analyzing economic statements which makes it tough for companies to evaluate their efficiency with these of other folks.

Users can analyze the earnings statement to see if firms are operating efficiently and making enough profit to fund their present operations and growth. Reading the financial statement will give an overall view of the condition of the small business and if there are any warnings indicators of possible future difficulties.

In the subsequent stage of monetary distress measurement, multivariate analysis (also recognized as Numerous Discriminant Evaluation or MDA) attempted to overcome the potentially conflicting indications that may possibly result from using single variables.