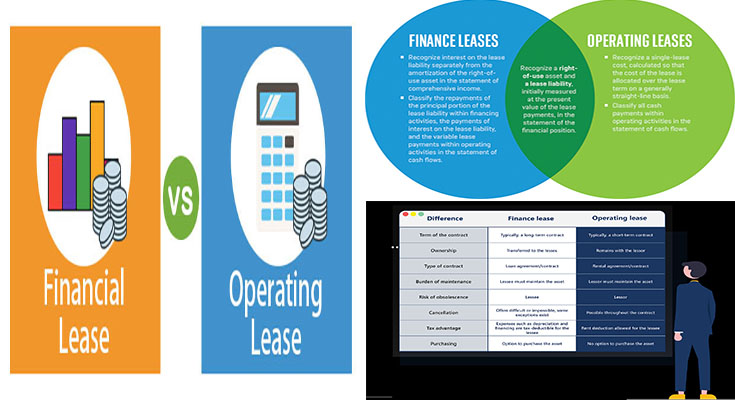

A financial vs operating lease depends upon the kind of asset. The former is suitable for long-term assets, whilst the latter is suitable for short-term assets. The main distinction between the two kinds of leases is that a finance lease has significantly less paperwork and doesn’t appear on the balance sheet. Also, a finance lease needs a lesser quantity of upfront money. GoCardless automates the collection of payments and aids businesses manage invoices, eliminating admin expenses associated with chasing outstanding invoices.

The key distinction involving the two varieties of leases is their term. Unless there is a substantial modification inside the use of the asset, a financial lease needs to be utilized. The new normal states that a finance lease just isn’t subject to cancellation through its initial period of use. But you can find nevertheless some variations among the two types of leases. These differences mean that it is significant to know how every single form of lease performs before you sign 1. The key difference between a finance lease and an operating lease could be the length of the lease. A finance lease is often a longer-term lease, although an operating lease is usually a shorter-term solution. In an operating-lease arrangement, the lessee retains ownership rights over the asset. This implies that they could determine no matter if or not they would like to sell the asset in the end of the lease. Even though finance leases require that the lessee sell the asset, an operating lease doesn’t need a sale.