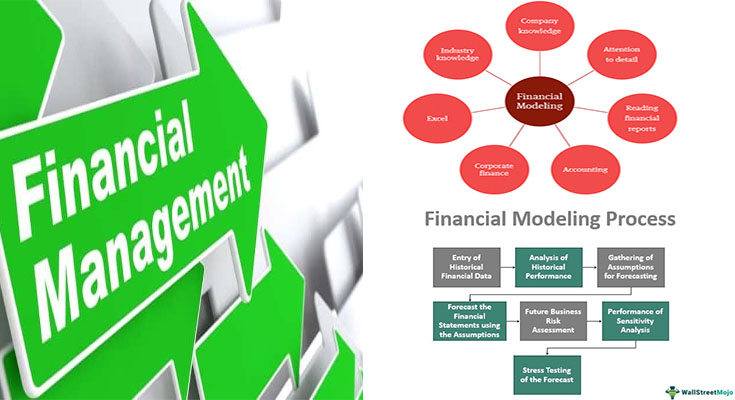

The significance of financial management models can’t be underestimated. Though all businesses have to have a business enterprise strategy, they grow to be critical planning tools when external funding enters the picture. Investors want comprehensive, correct, and timely financial information. They invest inside a company only if they believe they could recover the cash they invested. Consequently, financial models ought to supply investors using the data they need to have to create informed choices. Here is one of the most common uses of financial models.

Financial Models are an Incredible Tool for Forecasting Future Financial Performance

These models are frequently primarily based on spreadsheets and can be employed by both small and massive businesses. As a crucial risk management tool, they can assist you to comprehend the impact of enterprise choices. They allow you to play with unique scenarios to determine what the effects of a certain choice will probably be.

These models can also allow you to make great choices. This can be the most effective component of employing financial models – they let you make the proper ones without having to be concerned about creating the wrong one in particular.

Financial Management Models are a Beneficial Tool for Strategic Decision-Making

They make complex processes simpler and enable customers to compare numerous scenarios to ascertain the most effective path forward for an organization. They also enable businesses to adapt to modifications in the enterprise structure. You could use these tools to recognize opportunities and mitigate dangers. A well-designed financial model might help you make improved decisions and adapt to changes inside the market. So, get a model and prepare for it!

Financial Management Models for Budget Preparation

As you could see, financial management models are primarily based on the financial models that may be used for budget preparation. Additionally, they aid corporations make sensible decisions in terms of money management and liquidity. One of the most crucial benefits of utilizing these models is the fact that they enable you to understand the effect of business choices and can help you predict the future. The financial models enable you to test out various scenarios and decide how they would affect your company. These models are extremely useful in determining which solutions are going to be the most effective ones for you personally.

When building a financial model, you will need to take into account many variables. By way of example, it’s essential to look at the growth price of your business. Then, you’ll need to know the operating margins of one’s solutions. Then, you’ll need to establish the money flow from these solutions. Then, you’ll need to know the cost of refinancing. In case your business is in the same market as your competitors, you’ll need to evaluate your profitability. Then, it is possible to make improved choices.

There are Many Forms of Financial Management Models

The most common kind of financial management model is often a 3-statement model. It includes an earnings statement, a balance sheet, and a cash flow statement. These models are helpful in several conditions, however, they also can be made use of by banks when they need to assess their financial circumstances. They’re a fantastic solution to make informed choices for your enterprise. This tool is free and readily offered to any individual.