A small business owner should recognize the importance of sound financial management practices. Great practices are essential to developing a strong business. In addition to taxes and bookkeeping, it truly is also very important to keep track of personal finances and invest accordingly. These practices defend your investment and enable your business to grow and prosper. Listed here are several of the most important ones. You must ensure that you maintain your individual and enterprise finances in verification. Make sure that you take time to manage your business.

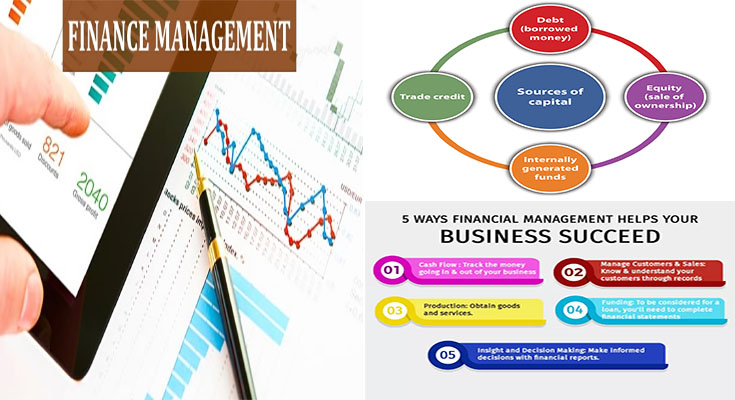

Financial management is a complicated approach that entails different aspects of a business, from managing the money flow of your business to generating financial statements. A well-developed financial management method will have precise requirements for all activities that happen to be performed by a small business. One of the most vital practices is detailed and outlined in the guide. Right here is an overview of the 5 key elements of a sound financial management program. Every single section focuses on a single area of your business.

Creating a sound financial management program is crucial for your business’ success. Efficient practices adhere to business requirements and federal and state compliance regulations whilst remaining aligned with long-term ambitions and future growth plans. Even though small corporations are certainly not held towards the same standards as public businesses, several of them do adhere to voluntary accounting requirements that demand far more detailed financial reporting. A sound financial management program should also evaluate state and federal regulations to ensure that all practices are compliant and proper for your company.

You need to be prepared to take on debt if you want your business to thrive. You should take into account hiring a bookkeeper or accountant to manage your business’ finances. As an alternative to taking out loans, use public transportation to reduce your expenditures. One more crucial financial management practice should be to be sure that you spend yourself. Additionally to paying yourself, you should consider hiring a bookkeeping service or consultant to assist you to manage your finances. In case you hire a bookkeeper, take into consideration a freelancer to manage your finances.

As a small business owner, you will need to be familiar with accounting practices to avoid costly blunders together with the IRS and state. Also, it’s essential to know how to balance your accounts. In the event you don’t understand how to maintain track of your financials, you danger losing funds by creating errors. And also you should never neglect to review your accounts for the reason that you are not confident you have got enough of them. You’ll find numerous ways to be certain you are always on top rated of the cash flow. Understanding the financial management practices of small businesses is quite essential. It will assist you to create the correct foundation to run your business. It’s essential to monitor the cash flow and expenditures. If you’re a for-profit organization, you will have to have to help keep track of the development of donations to the charity and how much it charges. By very carefully managing your money flow, you can develop your organization. Your company’s achievement will rely on your financial practices.