the finance lease system

finance lease and operating lease Securities are companies or parties that obtain financing in the form of capital goods from the lessor. Lessee in economic lease aims to get financing in the form of goods or equipment by way of installment payments or periodically. At the end of the contract, the lessee has option rights over the item. That is, the lessee has the right to buy goods leased at prices based on residual values. In an operating lease, the lessee can fulfill the needs of his equipment in addition to the operator and maintenance of the tool without risking the lessee to damage.

finance lease and operating lease Securities are companies or parties that obtain financing in the form of capital goods from the lessor. Lessee in economic lease aims to get financing in the form of goods or equipment by way of installment payments or periodically. At the end of the contract, the lessee has option rights over the item. That is, the lessee has the right to buy goods leased at prices based on residual values. In an operating lease, the lessee can fulfill the needs of his equipment in addition to the operator and maintenance of the tool without risking the lessee to damage.

She stood shivering ahead of me from the cold. The rag that hung about her waist was as soon as known as a shift, which is as black as the coal she thrusts and saturated with water, the drippings of the roof and shaft. During my …

the finance lease system Read More

The therapy of hurriers varied – but physical punishment was widespread. Occasionally a collier was prosecuted when he went also far, as in the case of a single who belted a hurrier in Waterhouse’s pit at Lindley in 1849 or the Kirkheaton collier who assaulted 1 in 1864. A hurrier was virtually throttled” by a collier in an argument about a tub in a Lepton pit in 1868. (33) Colliers could also be protective towards their hurriers if other people interfered with them. At Emley in 1856 an argument among two boys about the proper of way in the gate resulted in a single hurrier tipping the on-coming empty tub off the rails. He was consequently kicked by the other hurrier’s collier, despite the fact that complete tubs enroute to the pit bottom customarily had precedence. (34). A banksman was assaulted at Moorhouse’s pit at New Mill in 1857 by …

The therapy of hurriers varied – but physical punishment was widespread. Occasionally a collier was prosecuted when he went also far, as in the case of a single who belted a hurrier in Waterhouse’s pit at Lindley in 1849 or the Kirkheaton collier who assaulted 1 in 1864. A hurrier was virtually throttled” by a collier in an argument about a tub in a Lepton pit in 1868. (33) Colliers could also be protective towards their hurriers if other people interfered with them. At Emley in 1856 an argument among two boys about the proper of way in the gate resulted in a single hurrier tipping the on-coming empty tub off the rails. He was consequently kicked by the other hurrier’s collier, despite the fact that complete tubs enroute to the pit bottom customarily had precedence. (34). A banksman was assaulted at Moorhouse’s pit at New Mill in 1857 by …

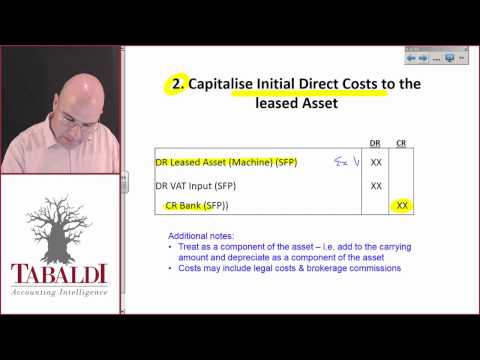

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets.

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets. China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.

China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.