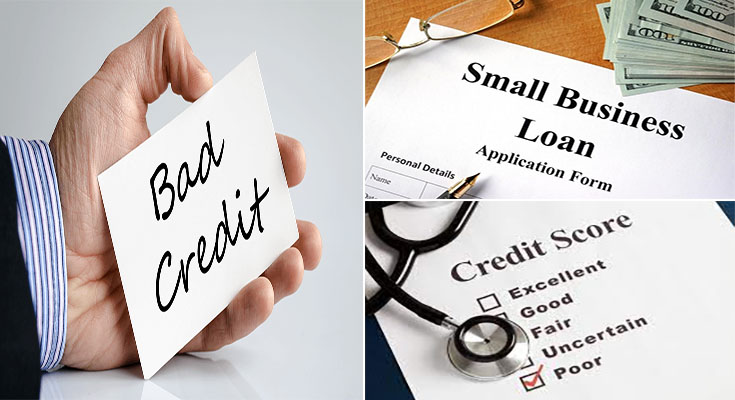

Bad Credit Small Business Loans – Startup Business Loans For Bad Credit Guaranteed

Also to a small business owner’s private credit score, bad credit scores can also have an effect on a business’s potential to receive financing. To help make certain your possibilities of approval, take into consideration establishing a better credit score. By following some recommendations, you could boost your credit score, making it a lot easier to receive financing. A bad-credit business enterprise loan can help you get started or expand your company. To have began, apply to get a no cost quote.

A FICO Score

If your credit score is below 600, you are going to possess a difficult time qualifying for a standard company loan. To avoid this, seek out an alternative lender. These organizations typically charge high rates of interest and do not accept applicants with scores below 500. In order to qualify, you need to possess a FICO score between 580 and 600. Additionally to applying on …

Bad Credit Small Business Loans – Startup Business Loans For Bad Credit Guaranteed Read More