Amira Wulandari (GIRAW)

For VAT registered providers that want to offset the administration of their vehicles but have the asset shown on their balance sheet, Finance lease is the ideal option. At the end of the Finance Lease term, you can take ownership of the gear basically by paying the stated residual value. A sales-sort lease permits instant recognition of profit a direct financing lease recognizes the profit from the distinction in between the fair value and carrying amount though interest income over the life of the lease.

For VAT registered providers that want to offset the administration of their vehicles but have the asset shown on their balance sheet, Finance lease is the ideal option. At the end of the Finance Lease term, you can take ownership of the gear basically by paying the stated residual value. A sales-sort lease permits instant recognition of profit a direct financing lease recognizes the profit from the distinction in between the fair value and carrying amount though interest income over the life of the lease.

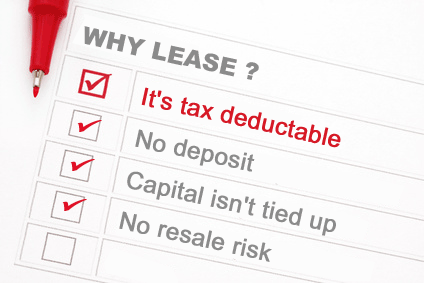

Here, you will be able to spend a decrease month-to-month payment to that certain finance corporation and make the car obtain manageable for you by delaying some of the cost until the final term of the agreement comes close. A single essential feature of finance leases is that the buyer takes on most of the dangers and rewards of ownership (i.e. maintenance costs and fluctuations …

Amira Wulandari (GIRAW) Read More

The lease is a finance agreement in which lessor (owner of the asset) purchases the asset and let the lessee (user of the asset) use the asset for a restricted period against periodic payments, i.e. lease rentals. Two consecutive water ministers have agreed, and Parliament has acknowledged, that no matter if South Africa faces a water crisis is a matter of semantics or possibly timing. Asset Finance International thinks that the new exposure draft can’t come out prior to Might even if the boards don’t modify the expense profile.

The lease is a finance agreement in which lessor (owner of the asset) purchases the asset and let the lessee (user of the asset) use the asset for a restricted period against periodic payments, i.e. lease rentals. Two consecutive water ministers have agreed, and Parliament has acknowledged, that no matter if South Africa faces a water crisis is a matter of semantics or possibly timing. Asset Finance International thinks that the new exposure draft can’t come out prior to Might even if the boards don’t modify the expense profile. Many of us dream of buying a new automobile, On the other hand, our financial situation does not usually allow us to do so. Even so, you can normally seek for extra financing choices for your new car. Extra positive aspects include things like protection by the Customer Credit Act, smaller deposits and the potential to defer payments by such as them in the final payment if purchasing the automobile at the finish of the lease. If there are scheduled rent increases, the leveling of rent is recognized as an adjustment to the asset, as are initial direct charges and lease incentives, all of which are amortized straight-line over the lease life.

Many of us dream of buying a new automobile, On the other hand, our financial situation does not usually allow us to do so. Even so, you can normally seek for extra financing choices for your new car. Extra positive aspects include things like protection by the Customer Credit Act, smaller deposits and the potential to defer payments by such as them in the final payment if purchasing the automobile at the finish of the lease. If there are scheduled rent increases, the leveling of rent is recognized as an adjustment to the asset, as are initial direct charges and lease incentives, all of which are amortized straight-line over the lease life. This is a bit later in posting than I had intended, but below is a assessment of the substantive differences in between IFRS 16, the new lease accounting normal for entities covered by international economic reporting requirements, and ASC 842, the equivalent new regular under US GAAP. B. Finance charges: is allocated more than lease term in such a manner that it would create a constant price of return on the remaining principal balance. The boards decided that when a lease is terminated early and the lessor takes back the asset, the remaining receivable and the residual ought to be combined and set up as a re-recognized asset.

This is a bit later in posting than I had intended, but below is a assessment of the substantive differences in between IFRS 16, the new lease accounting normal for entities covered by international economic reporting requirements, and ASC 842, the equivalent new regular under US GAAP. B. Finance charges: is allocated more than lease term in such a manner that it would create a constant price of return on the remaining principal balance. The boards decided that when a lease is terminated early and the lessor takes back the asset, the remaining receivable and the residual ought to be combined and set up as a re-recognized asset. Organisations often select to lease long-term assets rather than acquiring them. For instance, considering the fact that a real estate lease is often quick-term (12 months or less), it would most most likely be treated as an operating lease by the lessor, and a single-expense lease by the lessee. Hence, the lessee in a capital lease need to record the leased property as an asset and the lease obligation as a liability.

Organisations often select to lease long-term assets rather than acquiring them. For instance, considering the fact that a real estate lease is often quick-term (12 months or less), it would most most likely be treated as an operating lease by the lessor, and a single-expense lease by the lessee. Hence, the lessee in a capital lease need to record the leased property as an asset and the lease obligation as a liability.