Collector Bankruptcy Financial Reports

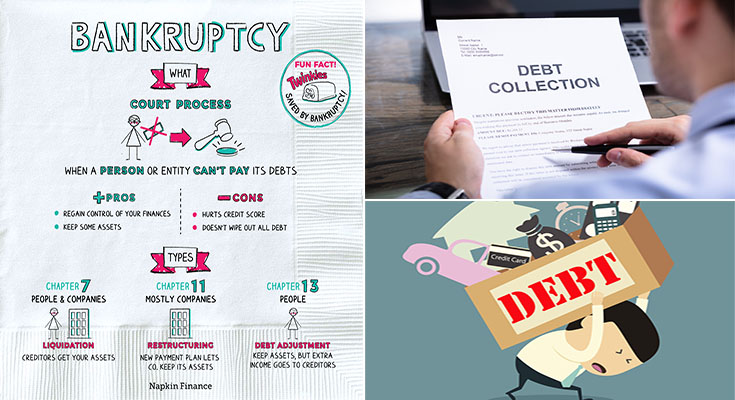

Financial reports of public firms are a fascinating element of our history. We all realize that public providers have higher stock rates, but did you know that additionally, they possess a lot of debt? The financial reports of a collector are a good example of that. They are a fantastic method to see how much a collector is spending – and where their money is going! This resource will provide you with an overview of the finances of your distinctive public businesses in your area.

A collector’s Financial Report

It is among the most significant components of a file and should include all the details vital to creating a good decision. You ought to be thorough and include all relevant information in the file. For those who never, you could be committing an error. The creditor may have each of the information and facts they have to have to collect …

Collector Bankruptcy Financial Reports Read More