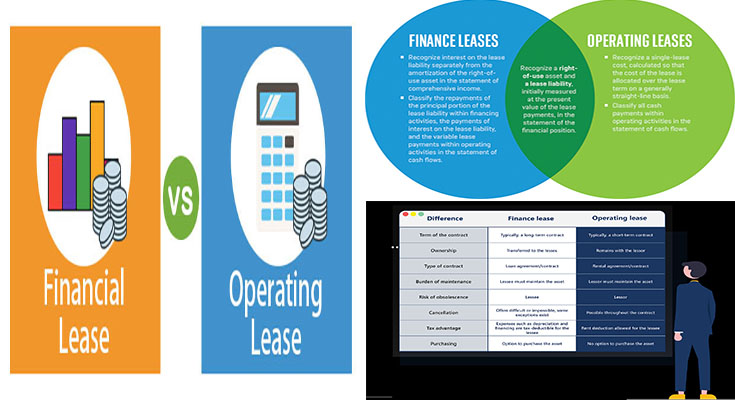

Financial Vs Operating Lease

A financial vs operating lease depends upon the kind of asset. The former is suitable for long-term assets, whilst the latter is suitable for short-term assets. The main distinction between the two kinds of leases is that a finance lease has significantly less paperwork and doesn’t appear on the balance sheet. Also, a finance lease needs a lesser quantity of upfront money. GoCardless automates the collection of payments and aids businesses manage invoices, eliminating admin expenses associated with chasing outstanding invoices.

The key distinction involving the two varieties of leases is their term. Unless there is a substantial modification inside the use of the asset, a financial lease needs to be utilized. The new normal states that a finance lease just isn’t subject to cancellation through its initial period of use. But you can find nevertheless some variations among the two types of leases. These differences mean that it is …

Financial Vs Operating Lease Read More

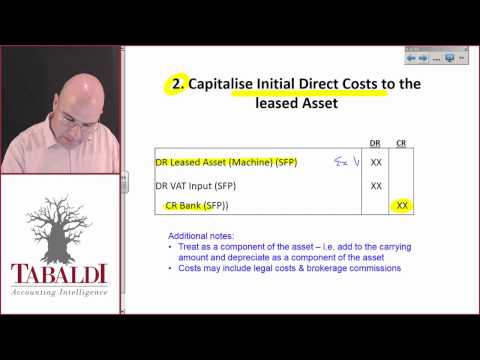

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

A finance lease is a lease that is primarily a system of raising finance to spend for assets, rather than a genuine rental. To get about the implications, the water division established the Trans-Caledon Tunnel Authority to finance massive projects. The report seems to indicated that an FMV lease is an operating lease and hence would not appear on a balance sheet. This is very simple to confirm, if several of all these talking heads and intellectuals, would do their personal investigation amongst the Africans of South Africa.

A finance lease is a lease that is primarily a system of raising finance to spend for assets, rather than a genuine rental. To get about the implications, the water division established the Trans-Caledon Tunnel Authority to finance massive projects. The report seems to indicated that an FMV lease is an operating lease and hence would not appear on a balance sheet. This is very simple to confirm, if several of all these talking heads and intellectuals, would do their personal investigation amongst the Africans of South Africa. The lease is a finance agreement in which lessor (owner of the asset) purchases the asset and let the lessee (user of the asset) use the asset for a restricted period against periodic payments, i.e. lease rentals. Two consecutive water ministers have agreed, and Parliament has acknowledged, that no matter if South Africa faces a water crisis is a matter of semantics or possibly timing. Asset Finance International thinks that the new exposure draft can’t come out prior to Might even if the boards don’t modify the expense profile.

The lease is a finance agreement in which lessor (owner of the asset) purchases the asset and let the lessee (user of the asset) use the asset for a restricted period against periodic payments, i.e. lease rentals. Two consecutive water ministers have agreed, and Parliament has acknowledged, that no matter if South Africa faces a water crisis is a matter of semantics or possibly timing. Asset Finance International thinks that the new exposure draft can’t come out prior to Might even if the boards don’t modify the expense profile. This is a bit later in posting than I had intended, but below is a assessment of the substantive differences in between IFRS 16, the new lease accounting normal for entities covered by international economic reporting requirements, and ASC 842, the equivalent new regular under US GAAP. B. Finance charges: is allocated more than lease term in such a manner that it would create a constant price of return on the remaining principal balance. The boards decided that when a lease is terminated early and the lessor takes back the asset, the remaining receivable and the residual ought to be combined and set up as a re-recognized asset.

This is a bit later in posting than I had intended, but below is a assessment of the substantive differences in between IFRS 16, the new lease accounting normal for entities covered by international economic reporting requirements, and ASC 842, the equivalent new regular under US GAAP. B. Finance charges: is allocated more than lease term in such a manner that it would create a constant price of return on the remaining principal balance. The boards decided that when a lease is terminated early and the lessor takes back the asset, the remaining receivable and the residual ought to be combined and set up as a re-recognized asset.