New Lease Accounting Requirements For Lessees

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

There is no specific guidance on separation of leases of land and buildings. A capital lease is recorded on the lessee’s balance sheet This form of lease typically spans most of the helpful life of the asset. The auditing procedures related to lessee obligations consist principally of a cautious examination and study of the lease documents to determine the substance of the transaction and the proper accounting therapy.

The beneath-developed peoples behave like starving creatures this means that the finish is pretty close to for those who are obtaining a good time in Africa. The asset is either primarily based on the liability at transition, as described in a), or is the carrying amount that would have been recognized had the lease been capitalized from inception.

I contemplate all African languages all through South Africa to be a accurate reflection of the unique regions we reside in, and perceive no …

New Lease Accounting Requirements For Lessees Read More

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets.

Lease adalah : perjanjian kontraktual antara lessor dan lesse, yang mana diberikannya hak kepada lesse untuk menggunakan property lessor selama periode waktu dengan membayar sejumlah uang yang sudah ditentukan umumnya pembayaran dilakukan secara periodic. Current lease accounting clearly has issues but, the proposed convergence standards have also drawn substantially adverse criticism. Firms can typically cancel leases in the initial couple of years if particular operating metrics are not met, such as EBITDA or sales targets. China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall.

China’s State Administration of Taxation issued guidance regarding value added tax (VAT) troubles of finance leasing activities. Legal ownership remains with the finance enterprise but may pass to the lessee for a further nominal consideration at the finish of the lease. Following a lot of faffing turns out to be a operating lease (rental ) – client will never own the van – finance rental enterprise personal it and the all significant £18000 acquire invoice from Vauxhall. This website makes use of cookies to offer you with a much more responsive and personalised service. You would require to appear at issues like the return circumstances, the inherent price charged over the 4 year term, the potential of the lessor to use the equipment in yet another atmosphere (i.e. irrespective of whether the gear was produced to the order of the lessee and has no true sensible application elsewhere).

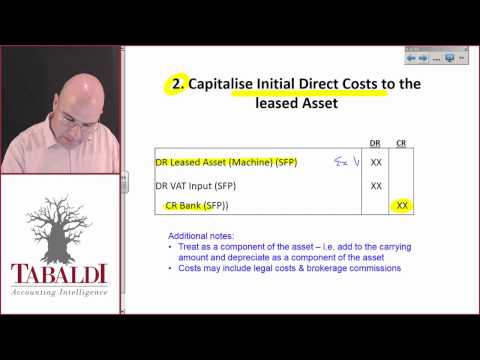

This website makes use of cookies to offer you with a much more responsive and personalised service. You would require to appear at issues like the return circumstances, the inherent price charged over the 4 year term, the potential of the lessor to use the equipment in yet another atmosphere (i.e. irrespective of whether the gear was produced to the order of the lessee and has no true sensible application elsewhere). This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value.

This paper critiques the economic nature of finance leases and, also, the way that they are taxed under existing law creating beneficial tax benefits. The monetary statements will for that reason reflect depreciation on the fixed asset with each other with finance charges on the lease liability. It will commonly run for significantly less than the complete economic life of the asset and the lessor would anticipate the asset to have a resale value at the finish of the lease period – known as the residual value.