Operating Vs Finance Lease

This is the company’s report card and it shows the financial position of the business enterprise at a specific date. So I suspect that in your example, if at the end of four years a lessor was carrying a genuine residual exposure in the gear of 25% and its margin return was dependent upon recovering that residual investment then it would satisfy the 1st test above (bear in mind the old SSAP21 90/10 rule).

Arguably the revenue must be indifferent to a finance lease becoming taxed in the exact same way as other varieties of leases. The fact that the rentals do not cover the cost is a nonsense, the alternative for a peppercorn rent at the finish of the lease proves that the asset is fully paid for by then, no matter what the headline cost says.

Income tax implications: Operating lease is 100% tax deductible supplied the equipment …

Operating Vs Finance Lease Read More

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes.

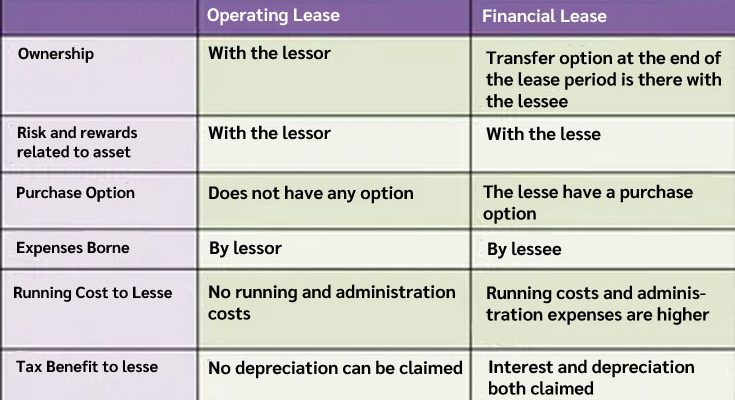

The FASB and IASB teamed up and mutually agreed upon a a lot more representative method to accounting for leases that will most likely come into impact in the next few years. Taxpayers that offer finance leasing services of movable assets and transfer their lease-related receivables to financial institutions (like banks) beneath a factoring arrangement, are nonetheless needed to issue VAT invoices to the lessee and to report the relevant quantity of taxable revenue for VAT purposes. As stated in IAS 17 : Leases, there are two classifications of lease transaction that applicable in the monetary statements of the lessee : (1) Operating leases and (two) Finance leases. In addition, for these vehicles with CO2 emissions exceeding 130 g/km there is a flat rate disallowance of 15% of the successful rental in accordance with the rules governing the lease rental restriction. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).

As stated in IAS 17 : Leases, there are two classifications of lease transaction that applicable in the monetary statements of the lessee : (1) Operating leases and (two) Finance leases. In addition, for these vehicles with CO2 emissions exceeding 130 g/km there is a flat rate disallowance of 15% of the successful rental in accordance with the rules governing the lease rental restriction. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).