At present, GAAP needs that the lessor incorporates the underlying property in its balance sheet when figuring out finance lease treatment. This implies that the lessee will have to contain the asset and liability on its balance sheet. The asset represents the appropriate use of the underlying house when the liability represents the present value in the lease payments. More than the life of your lease, the asset and liability will minimize. Other components affecting the worth of the assets and liabilities incorporate incentives and indirect costs from the lease.

As opposed to the financing lease, a finance lease is not going to be taxed the same way as an operating lease. Rather, the lessor is viewed as the owner in the underlying home and hence, can love the full tax advantages of the transaction. In addition, lessees can deduct the full rental payment, and no part of it is characterized as interest. Moreover, the new limitation on the interest deduction won’t apply to the payment of a finance lease.

The Finance Lease Treatment For The Lessor

It is dependent upon no matter whether the lease is a capital lease or an operating lease. The former calls for the lessee to recognize a lease liability on its balance sheet and is treated as an operating expense. The latter is distinctive in the finance lease because the lessee becomes the owner with the leased asset at the finish of the lease term. The latter makes it possible for the lessee to buy the asset at a lower value than the fair marketplace worth at the end of your lease term.

The finance lease treatment for the lessor is equivalent to the legacy GAAP. Each model recognizes the cost of the leased asset at the beginning of the lease and throughout the lease.

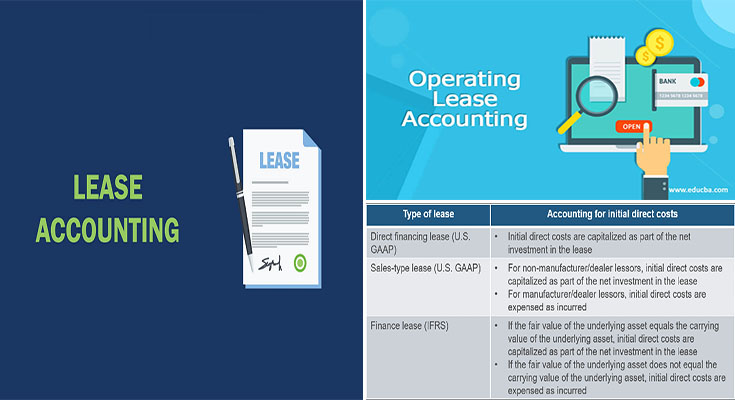

Beneath the new guidance, lessors ought to recognize their fees over the lease term as an alternative to in the end from the lease. Also, initial direct fees are no longer allowed to become charged to expense as they happen. Nonetheless, the dealer and manufacturer lessors possess the capability to charge initial expenses to expense once they are incurred.

The New Accounting Normal is Largely Related to the Present Requirements

A finance lease is a contract involving a lessee and also a lessor. It is the transfer of management of an asset for the lessee. The lease can be classified as an operating or capital lease. Having said that, the lease ought to be categorized as an operating lease. This type of arrangement will not transfer ownership of an asset. Even though you will discover some differences between the two types, both are frequently classified as a leasing arrangements. The lessor has to account for the ROU asset’s residual value. This means that the lessor will have to calculate the present worth in the lease payments. A discount rate is an implicit price in the lease. As an example, when the lessee utilizes a discounted rate, the lease is usually a financing asset. A capital asset is an illiquid asset. It is hence critical to consider the influence of your discount rate when calculating the financing expense of a capital asset.