Online Finance Tools to Manage Your Finances

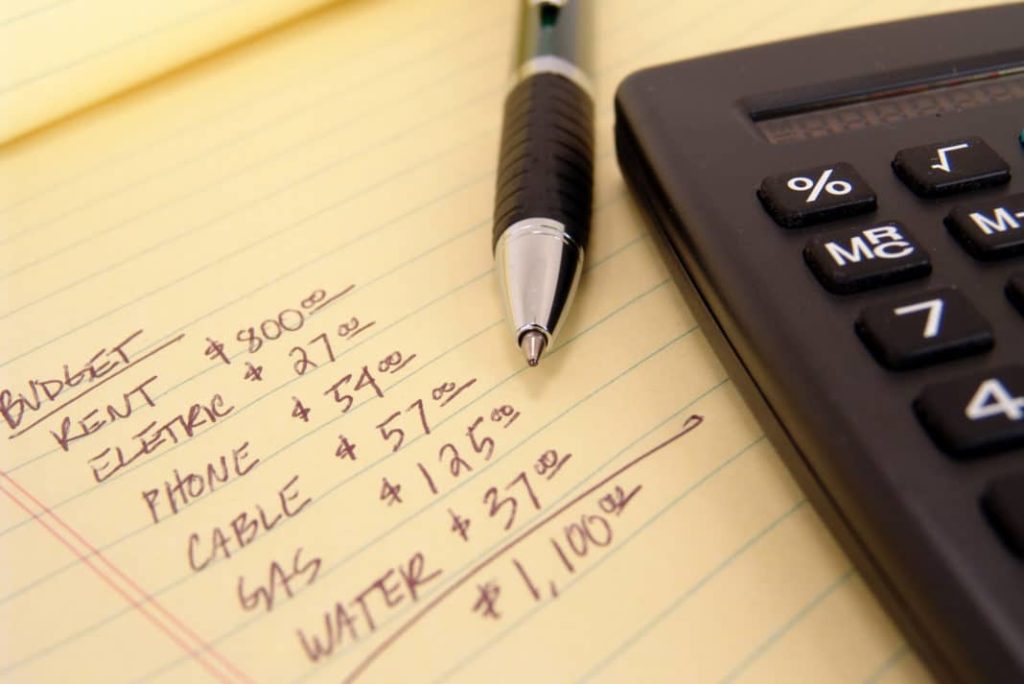

Managing one’s finance is not easy. It takes lots of time to track down your entire expenses than to create a report on all expenses. You will have to get all your bank details, mortgages, loan details, bank card account, and so on. So the traditional pencil and paper approach to personal finance management can not work in your case today.

Do you have to be confused about how to handle it then? Thank Heavens for the latest technology that we have today for calculating the cost and finance details. You get on the web and hunt for some online personal finance management tools. You will find hundreds of them. There are free tools you can use to create simple calculations. You will also find huge personal finance management tools that can be used to calculate your budget and plan finance of business organizations too.

Now you’ve got hundreds of …

Online Finance Tools to Manage Your Finances Read More