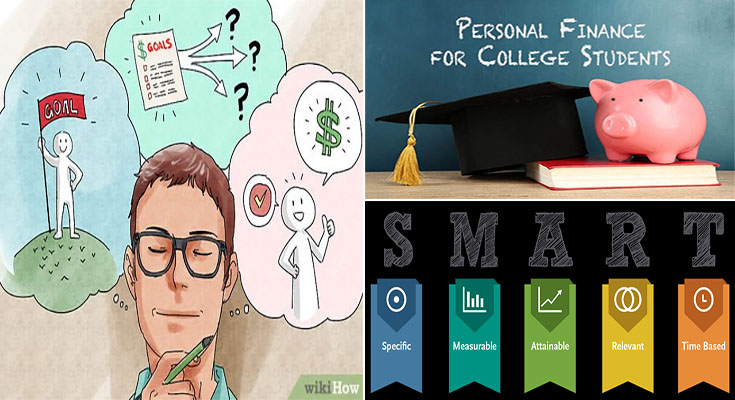

You may have heard of personal financial organizing, but how do you make 1? The method can be easy or complex, based on your circumstances. The very first step would be to prioritize your ambitions. Prioritize by far the most significant targets first. Then, move on towards the longer-term ones. For example, you may choose to build an emergency fund of 3 to six months’ worth of costs.

This fund is an excellent location to place cash in case of job loss, illness, or injury.

For those who have earnings from numerous sources, it might be difficult to preserve track of it all. A personal financial plan really should incorporate investment opportunities and savings. When investing might be a superb solution to build wealth, you should be cautious to make sure which you select the best funds for your demands. You may also make an estate plan to supply your beneficiaries together with the money they need. Your plan really should include facts about the best way to make alterations for your plan if situations change.

A Retirement Plan

Your monetary plan should also contain a retirement plan. A 401K choice allows you to automate your contributions. A traditional IRA enables you to defer taxes till you withdraw your funds. So long as you could stay on track with your payments, it is possible to get pleasure from your nest egg at retirement. As you strategy retirement, take into consideration adding for your savings and maintaining your housemate. In brief, personal financial plans are an incredible strategy to reach your economic targets.

Moreover to a retirement plan, your financial plan needs to incorporate a long-term care insurance coverage policy. That is an important part of one’s financial plan, and it must be incorporated inside your estate planning. The proper plan should cover all of your health-related and legal decisions. Ultimately, make certain your plan considers revenue tax. Avoiding this tax is amongst the finest techniques to keep much more of the dollars in your pocket. The proper advisor can assist you to make the best choices to reduce your tax burden and maximize your assets.

Your Financial Plan Really Should Start by Having a Detailed Net Worth Statement

This may establish your beginning point. Then, you need to create an investment portfolio. Investing in stocks and mutual funds is a very good solution to diversify your portfolio. If you are a brand new college graduate, you could desire to consider an investment inside a genuine estate fund. A plan for this goal is crucial to your long-term happiness. It is best to take into consideration whether the method operates for you.

Your Financial Plan Needs to be As Detailed as You Can

Your finances ought to be as transparent as you can. You can also add a handful of targets to your plan. Getting an effective monetary plan can help you to become more successful in life. A fantastic way to do that is to set some objectives and make a budget for your expenses. This will likely permit you to price range additional efficiently and save more for the future. For anyone who is already married, this will be an awesome technique to get started saving for the future.