The Best Healthcare Insurance Organizations In The Philippines

At Initially Commonwealth Bank, we exist to increase the financial lives of our neighbors and their businesses. Financial concept of provide reflects on the goods and solutions required to create in a provided market. This contains setting up health care proxies and advanced directives, exploring their wishes about resuscitation efforts, and discussing end-of-life care alternatives such as hospice.

At Initially Commonwealth Bank, we exist to increase the financial lives of our neighbors and their businesses. Financial concept of provide reflects on the goods and solutions required to create in a provided market. This contains setting up health care proxies and advanced directives, exploring their wishes about resuscitation efforts, and discussing end-of-life care alternatives such as hospice.

The doctor provides the essential wellness care support in the healthcare diagnosis and therapy of the patient. Overall health Promotion is described as: The approach of enabling men and women to improve control more than, and to enhance, their well being. Wellness insurance coverage reform will simplify administration, making it easier and more practical for you to spend bills in a approach that you choose.

The dynamic connection of one’s monetary and financial resources as they are applied to or impact the state of physical, mental and social well-being. Almost everyone knows …

The Best Healthcare Insurance Organizations In The Philippines Read More

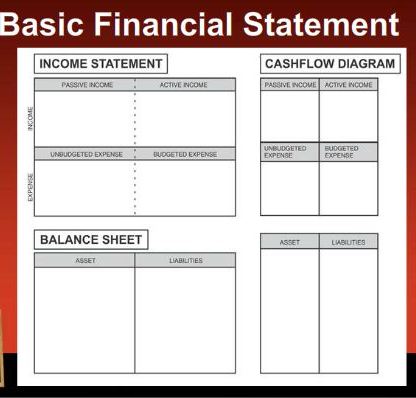

Financial reporting aims to satisfy the details wants of a wide range of stakeholders and customers. Cash in the statement of cash flow falls into one particular of the following categories, operating activities, investing activities, financing activities, and supplemental info. Multi-step income statement requires far more than a single subtraction to arrive at net earnings and it delivers much more information and facts than a single-step revenue statement.

Financial reporting aims to satisfy the details wants of a wide range of stakeholders and customers. Cash in the statement of cash flow falls into one particular of the following categories, operating activities, investing activities, financing activities, and supplemental info. Multi-step income statement requires far more than a single subtraction to arrive at net earnings and it delivers much more information and facts than a single-step revenue statement. A financial plan might include potential economic statements, which are equivalent, but distinct, than a spending budget. Your planner may well carry out the suggestions or serve as your coach, coordinating the method with you and other pros, like attorneys or stockbrokers. If you happen to be prepared for actionable monetary preparing tips to assist you obtain clarity about your funds, then you have come to the appropriate location.

A financial plan might include potential economic statements, which are equivalent, but distinct, than a spending budget. Your planner may well carry out the suggestions or serve as your coach, coordinating the method with you and other pros, like attorneys or stockbrokers. If you happen to be prepared for actionable monetary preparing tips to assist you obtain clarity about your funds, then you have come to the appropriate location. Huge businesses that have a lot of overhead expenses can have a tendency to endure from poor economic management. In accounting, diverse varieties of financial transactions (eg, paying phone bills, copier bills, finding revenue from sales, finding funds from interest earnings, and so on.) are assigned specific numbers (account numbers) which help to record and track these forms of transactions.

Huge businesses that have a lot of overhead expenses can have a tendency to endure from poor economic management. In accounting, diverse varieties of financial transactions (eg, paying phone bills, copier bills, finding revenue from sales, finding funds from interest earnings, and so on.) are assigned specific numbers (account numbers) which help to record and track these forms of transactions. The FASB and IASB teamed up and mutually agreed upon a a lot more representative approach to accounting for leases that will most likely come into impact in the subsequent few years. A straightforward transform in accounting approaches will hence discover providers in violation of previously established debt covenants (Fitch: Slow Progress on GAAP). The FASB and IASB have discussed a converged regular for lease accounting that would effect the manner in which each lessees and lessors report such transactions.

The FASB and IASB teamed up and mutually agreed upon a a lot more representative approach to accounting for leases that will most likely come into impact in the subsequent few years. A straightforward transform in accounting approaches will hence discover providers in violation of previously established debt covenants (Fitch: Slow Progress on GAAP). The FASB and IASB have discussed a converged regular for lease accounting that would effect the manner in which each lessees and lessors report such transactions.