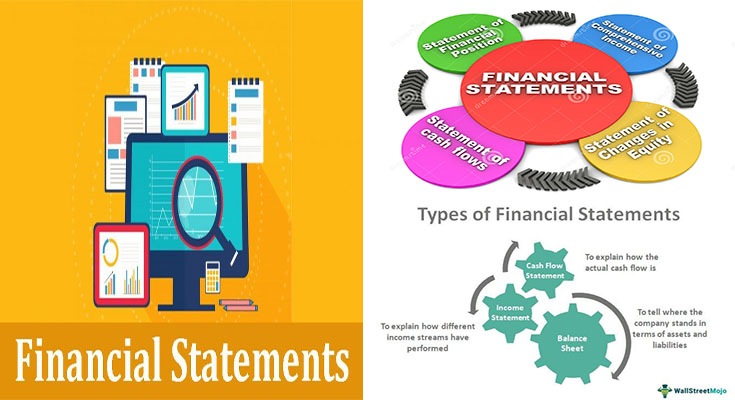

Types of Financial Statements

You will find four main kinds of financial statements: revenue statement, cash flow statement, and balance sheet. No matter if they’re created quarterly, monthly, or yearly, the purpose of every kind of statement is the same. Commonly, financial statements really should be ready in standardized formats. The following examples highlight probably the most popular kinds of financial statements. Let’s appear at everyone in extra detail. And don’t forget, if you’re unsure of what they imply, you’ll be able to generally ask your accountant or bookkeeper for suggestions.

Balance Sheet

A balance sheet can be a statement of how much the enterprise has in equity. This consists of the number of shares and also the value from the company’s assets. They are important pieces of information and facts for shareholders. The income statement shows the volume of money generated by the firm. The money flow statement specifics the level of money …

Types of Financial Statements Read More